Part 6: Monitoring

6.1

In this Part, we describe the monitoring arrangements for STAPP.

6.2

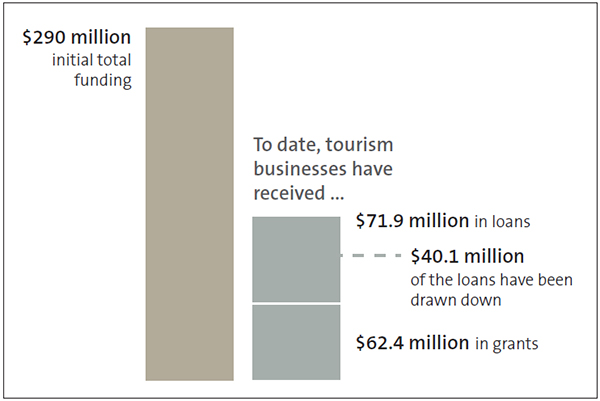

A significant amount of public money has been provided to the tourism sector through STAPP (see Figure 8). To date, tourism businesses have received:

- loans totalling $71.9 million; and

- grants totalling $62.4 million.

Figure 8

Amount of funding provided through the Strategic Tourism Assets Protection Programme, as at 6 March 2022

Source: Office of the Auditor-General

6.3

The Tourism Recovery Ministers appear to have taken some reassurance that STAPP criteria had been met through declarations that tourism businesses made in their applications, Deloitte's financial assessment, and contract monitoring processes.

6.4

Deloitte had advised the Ministry about the constraints and limited assurance that the financial assessment process provided. Deloitte considered that additional protection could be provided by partially distributing funds and implementing follow-up processes to check that tourism businesses:

- remained eligible for funding by meeting loan conditions; and

- still needed STAPP funding due to reduced revenue throughout the funding period.

6.5

We wanted to understand what monitoring the Ministry had put in place, the extent to which the monitoring process could substantiate the accuracy of the tourism business's information, and whether the tourism business had maintained eligibility for funding.

6.6

We talked to Deloitte to understand what analytical support work it had been asked to do. The review process aimed to provide reassurance that STAPP funding had been used in accordance with grant conditions, that the STAPP funding did not duplicate other forms of government support, and that the basis on which funding was granted was supported by subsequent tourism business performance.

What monitoring processes were put in place for successful applicants?

Six-monthly reports

6.7

The grant and loan agreements stated that tourism businesses that received funding could be reviewed at any time or asked to provide further information. There is a clause in the grant agreements that tourism businesses must maintain eligibility to receive funding throughout the duration of the grant agreement and must declare that they continue to be eligible for funding.

6.8

Tourism businesses that received grants have to provide six-monthly reports, including profit and loss statements, for the period as well as information about:

- full-time equivalent employee numbers;

- visitor numbers for the period shown against the same period in 2019;

- a description of how the STAPP funding had been used in the previous six months and how the tourism business intends to use the next round of funding; and

- a description of progress made against funding indicators the tourism businesses had selected when negotiating their contracts.

6.9

The Ministry reviews these reports. The Ministry told us that it staggered grant payments so that it could withhold payments if eligibility lapsed or adjust the final payment to reflect any other subsidies received. In September 2021, a further round of six-monthly reporting was provided by tourism businesses. Of the 127 tourism businesses that had received grants, 82 claimed their final payment in that six-monthly reporting period24 and a further 35 claimed their final payment in February/March 2022.25

Dealing with the risk of double payment

6.10

The Ministry asked Deloitte to analyse whether there had been any overlap between STAPP grant funding and other subsidies. Deloitte sent tourism businesses a questionnaire asking what the STAPP funding has been used for, whether they still need funding, and what their future needs are.

6.11

Deloitte has been clear that it carried out a financial review and not an audit or due diligence. The process was not set up to detect fraud, to look at what has been taken out of tourism businesses over recent years, or at related-party transactions.

6.12

Deloitte considered potential sources of duplicate funding: the wage subsidy scheme extension, resurgence payments, Wildlife Institutions Relief funding, and Department of Conservation concessions.26

6.13

The Ministry advised Deloitte that it did not consider the wage subsidy scheme extension or resurgence payments to be duplicate funding. This is because tourism businesses would have already moved to their reduced operating model and the STAPP funding was to compensate for loss of revenue due to the border closure and lockdown. This appears to contrast with the Ministry's earlier advice to the Tourism Recovery Ministers that the impact of the wage subsidy scheme would ideally need to be factored into any agreements by removing aspects of funding that duplicated wage subsidy scheme payments. We were told that tourism businesses could use STAPP funding to top up wage subsidy scheme funding. However, Deloitte told us that it was hard to tell from many tourism businesses' financial records if STAPP did duplicate wage subsidy scheme payments.

6.14

The Ministry also decided that the Wildlife Institutions Relief funding did not duplicate STAPP funding as long as payments were not applied to the same costs that were requested when applying for STAPP funding.

6.15

The main source of duplicate funding was Department of Conservation concession fee waivers, which in many cases formed part of the operational costs that tourism businesses proposed using STAPP to cover in their application. For 72 tourism businesses, there was a funding overlap due to Department of Conservation support totalling $386,156.

6.16

For tourism businesses that still needed STAPP funding, and which have received duplicate funding, the Ministry can reduce the final payment by the amount of the overlap. We understand that the Ministry intends to apply a materiality threshold of 1% or $5000 (whichever is lower), meaning that it would not seek to recover or adjust payments under $5000.

6.17

Deloitte and the Ministry concluded that 121 tourism businesses still needed funding and four did not.27 We understand that two of the four tourism businesses assessed as no longer needing STAPP funding had already advised that they were declining further STAPP funding in the form of the grants and loans. The Ministry planned to inform the other two tourism businesses that their funding agreements would be terminated.

Closer scrutiny of some tourism businesses

6.18

The Ministry also commissioned Deloitte to do a "deep dive" into 25 tourism businesses. The Ministry provided a list of tourism businesses that it wanted Deloitte to look at. Deloitte selected the remaining tourism businesses.

6.19

Deloitte obtained the tourism businesses' full balance sheets and profit and loss statements. Deloitte looked at:

- what funding amount the tourism business applied for originally;

- how the tourism business had used the funding;

- whether there were funding overlaps;

- whether the tourism business still needed funding support; and

- whether the tourism business was in a strong enough position to seek alternative financing.

6.20

The review intended to provide some reassurance that the claims about drop in revenue made by tourism businesses was because of subsequent events.

6.21

As with the initial applications, there was inconsistency in the data provided by tourism businesses. Deloitte told us that the STAPP funding was not always evident from the profit and loss statements, and that some tourism businesses might have used the STAPP funding to pay for an asset, to reduce debt, or meet some other liability.

6.22

Due to the flexibility in the funding agreements, Deloitte told us that it was not sure what the funding was specifically granted for. If a tourism business had asked for $8 million and was granted $1 million, for example, Deloitte would ask what the funding had been spent on because it was not clear how much funding was meant to be allocated to specific line items such as wages, repairs and maintenance, or leases.

6.23

Deloitte rated the 25 tourism businesses according to whether they faced a low, medium, or high level of risk reflecting their financial viability and sustainability (see Figure 9). This provides a deeper insight into whether tourism businesses still needed STAPP funding and the likelihood of them being able to source alternative funding.

Figure 9

Deloitte's risk assessment of 25 applications

| Score | Definition | Number of tourism businesses assessed with this score |

|---|---|---|

| Low risk | The tourism business might be able to obtain funding on commercial terms. | 1 |

| Medium risk | The tourism business might have difficulty obtaining funding from other sources on commercial terms. | 10 |

| High risk | The tourism business had a high risk of not being able to obtain funding on commercial terms. | 14 |

6.24

Deloitte commented that even tourism businesses that appeared to have balance sheet equity that might act as a buffer against short-term losses, key questions or policy choices arise. These include:

- whether equity could in fact be realised, for example, was the equity key property assets essential to delivering the service;

- the willingness of lenders to lend based on equity in the face of erratic cashflow; and

- the extent to which wider group assets should be considered.

6.25

Although access to balance sheet information enabled Deloitte to form a view on financial capacity, it commented that this did not provide any greater certainty about future financial prospects or cashflow, particularly considering the international and domestic uncertainty about the ongoing impact of Covid-19 on international and domestic travel. In many respects, these comments reinforce officials' early advice on STAPP, which noted that not every tourism business would survive, and that some of those that did receive funding might still fail.

Need to review the effectiveness of STAPP

6.26

The trajectory and sustained duration of Covid-19 has differed significantly to what was envisaged when STAPP was designed in May 2020. By the time the Tourism Recovery Ministers made decisions about STAPP, Ministry officials were uncertain about how effective STAPP might be. The Tourism Recovery Ministers' decisions were made against a backdrop of uncertainty as to whether some key criteria had been met. Considering these factors, and to ensure that future schemes build on the lessons learned from STAPP, we suggest that the Ministry formally review the effectiveness of STAPP against its stated goals.

24: Final funding payments during the period of March-September 2021 totalled $9.3 million.

25: Final payments in 2022 for 35 recipients will total $2.5 million.

26: Most contracts started after the completion of the first wage subsidy scheme so there is no overlap there.

27: Deloitte grouped seven businesses from one parent company together, meaning that 121 assessments were carried out in respect of 127 businesses that received STAPP funding.