Appendix: Summary of the two models and their projections

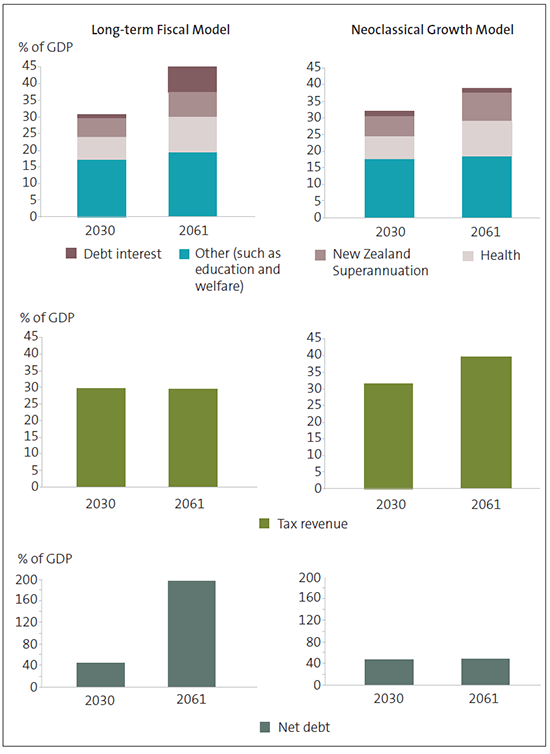

The Long-term Fiscal Model and the Neoclassical Growth Model use radically different frameworks and assumptions to project the financial position of the government over 40 years. The Neoclassical Growth Model is a technically sophisticated economic model, and the Long-term Fiscal Model is a simpler accounting-based projection with few economic behaviours built in.

The Long-term Fiscal Model holds tax revenue constant and assumes the additional spending is funded by increasing debt (which increases the interest on that debt). The Neoclassical Growth Model holds net debt constant and assumes the additional spending is funded by increasing tax revenue.

Figure 6 summarises the differences between the models. It shows how and why the two projections change from 2030 to 2061 (see also Figure 2 and Figure 3).

Figure 6

Increases in superannuation and healthcare spending are funded differently in the Long-term Fiscal and Neoclassical Growth models

Source: Office of the Auditor-General.