Part 2: Reporting on outcomes and benefits could be improved

2.1

In this Part, we look at the Agency and contract teams’ performance in maintaining state highways. We discuss:

- whether the contract teams are meeting their performance indicators in the contract;

- the extent to which the performance measures included in the contracts support an assessment of their contribution to the Agency’s outcomes;

- whether the Agency is assessing the benefits of the contracts;

- the benefits of the contracts; and

- the trade-offs the Agency made to get those benefits.

2.2

Given the significance of the contracts in maintaining state highways, we expected the Agency to monitor the performance of the contract teams to assess whether it has received what was contracted and whether the contracts deliver value for money.

2.3

We expected the measures and indicators for assessing the contract teams’ performance to be clearly aligned with the Agency’s organisational performance framework, including its strategic priorities and desired outcomes.

2.4

We also expected the Agency to be clear about the benefits it expected to achieve from introducing the Network Outcomes Contract model, and to monitor and report on whether it achieved those benefits. Based on its assessment, we expected the Agency to take any steps needed to achieve those benefits.

Summary of findings

2.5

The contract teams are mostly meeting their key performance indicators. However, the performance indicators under the network performance key result area do not include an assessment of the overall road condition being delivered, and many key performance indicators are focused on outputs or compliance. The extent to which the measures enable an overall assessment of road condition and link to the Agency’s overall outcomes is unclear.

2.6

For the latest round of contracts, the Agency has made changes, such as removing some of the compliance-based key performance indicators and considering introducing a network condition key performance indicator. If done, this should help provide a better link between the assessed performance of the contract teams and how they are contributing to the Agency’s outcomes of safe, reliable, and resilient state highways.

2.7

The Agency has not assessed whether it has received the benefits it expected from introducing the Network Outcomes Contract model. We recommend that the Agency monitor and report on the outcomes and benefits of maintaining the state highway network through the contracts to ensure that the contracts are fully effective and efficient.

2.8

Based on our analysis, we consider that the Agency has achieved some of the expected benefits from introducing the Network Outcomes Contract model, including a greater understanding of the need for proposed renewals and a more nationally consistent process to identify and approve those renewals. This has contributed to reduced spending on renewals. Subcontractors have also benefited from a better understanding about the trends affecting the wider industry and from the larger suppliers transferring knowledge to them because of the Agency’s requirement for suppliers to give them a minimum percentage of work.

2.9

However, in achieving these benefits, the Agency has made some trade-offs. This includes deferring renewals, which might be appropriate but could create a long-term risk to the condition of state highways. To manage the associated risks from the trade-offs, the Agency needs to monitor and report on them closely.

Contract teams are mostly meeting their performance indicators

2.10

The Agency monitors the performance of each contract team and gives them an overall performance score. The overall performance score is calculated from how well contract teams did against key result areas. Each key result area has several key performance indicators.

Overall performance score

2.11

Every year, each contract team receives an overall performance score out of four (a score of two or more is acceptable performance). From 2015/16 to 2018/19, the average overall performance score for the contract teams ranged from 2.92 to 3.13. During this period, most contract teams achieved the overall minimum acceptable standard. However, the contract team with the lowest score in 2015/16 achieved a performance rating of poor even though its overall performance score was above two. This was because two of the underlying key result areas had a score of less than two.

Key result areas

2.12

A contract team’s overall performance score is calculated from the individual scores against the key result areas. The key result areas that are currently scored are:

- assurance and value;

- customer;

- health and safety;

- network performance;

- road user safety; and

- sustainability.

2.13

The key result area for the health of the relationship between the Agency and the supplier is not currently scored.

2.14

The Agency rates the scored key result areas from one to four every four months. A score of two or more is acceptable performance.6 Figure 5 shows that, on average, the contract teams are achieving the key result areas.

Figure 5

Average overall score (and range of scores) against the key result areas, from 2015/16 to 2018/19

| Key result area | 2015/16 | 2016/17 | 2017/18 | 2018/19 |

|---|---|---|---|---|

| Assurance and value | 2.6 (1.0-4.0) | 2.4 (1.3-3.1) | 2.7 (1.3-3.7) | 2.8 (2.0-3.8) |

| Customer | 3.2 (2.1-4.0) | 3.4 (2.8-4.0) | 3.5 (3.1-3.8) | 3.3 (2.7-3.8) |

| Health and safety | 3.6 (2.8-4.0) | 3.3 (2.6-3.7) | 3.4 (2.6-4.0) | 3.5 (2.6-4.0) |

| Network performance | 3.0 (1.7-3.5) | 2.9 (2.2-3.4) | 3.0 (2.2-3.8) | 3.0 (2.4-3.8) |

| Road user safety | 2.9 (2.0-3.8) | 2.4 (1.7-3.1) | 2.5 (2.0-3.0) | 2.8 (2.2-3.6) |

| Sustainability | 3.3 (2.0-4.0) | 3.1 (2.4-3.8) | 3.2 (2.3-3.8) | 3.3 (2.8-3.8) |

Source: Office of the Auditor-General, using data from the New Zealand Transport Agency.

2.15

From 2015/16 to 2018/19, the overall average score for most of the key result areas is relatively stable, with some improvement in the scores for the lower-performing contract teams. This indicates that the contract teams are, on average, meeting acceptable standards of performance against the key result areas.

Key performance indicators

2.16

Each key result area has several key performance indicators. The key performance indicators range from measuring whether the contract team has an emergency procedures preparedness plan to the trend for deaths and serious injuries in its region.

2.17

We reviewed how the contract teams performed overall against each of the 22 reported and scored key performance indicators from 2015/16 to 2018/19. As an overall national average against each key performance indicator, the contract teams achieved their key performance indicators.

2.18

However, after improving in 2015/16, the death and serious injury trend worsened in 2016/17 and 2017/18. This means more people were killed or injured on state highways in 2016/17 and 2017/18 for each vehicle kilometre travelled compared with the previous year. In 2018/19, the key performance indicator score did improve.

2.19

Although effectively maintaining state highways helps make them safer, how well they are maintained is only one of several factors that can contribute to deaths and serious injuries on state highways.

2.20

On average, the contract teams tend to score highly on the compliance- or input-based key performance indicators. Figures 6 and 7 show the seven highest and five lowest average key performance indicator scores for 2018/19, and the range.

Figure 6

Highest seven average key performance indicator scores, 2018/19

| Key performance indicator | Score and performance level |

|---|---|

| Traffic control plan – The contract team makes effective, consistent use of its traffic control plan to provide a safe environment for staff and road users by using, auditing, and reviewing it regularly. | 3.9 – Outstanding (3.0-4.0) |

| Emergency procedures preparedness plan – The contract team makes effective, consistent use of its plan to ensure that the team is ready to react to incidents on the network, and continuously improves its management of incidents by using, auditing, and reviewing the plan regularly. | 3.9 – Outstanding (3.0-4.0) |

| Customer and stakeholder communications management plan – The contract team makes effective, consistent use of its plan to manage communications with customers and stakeholders, by using, auditing, and reviewing it regularly. | 3.9 – Outstanding (3.0-4.0) |

| Network safety trend report – The contract team demonstrates its understanding of the safety issues on the network. It is proactively seeking improvement opportunities, implementing improvements, and monitoring their effectiveness. | 3.8 – Outstanding (3.0-4.0) |

| Environmental and social management plan – The contract team makes effective, consistent use of its plan to manage the impact of its activities on the physical and social environment by using, auditing, and reviewing it regularly. | 3.8 – Outstanding (3.3-4.0) |

| Communications of impact of events and incidents on customers – The contract team communicates proactively with customers, giving them timely, reliable information about planned and unplanned events on the network. | 3.8 – Outstanding (2.7-4.0) |

| Environmental triangle – The contract team demonstrates commitment to environmental and social responsibility throughout its activities under the contract. | 3.8 – Outstanding (3.0-4.0) |

Source: Office of the Auditor-General, using data from the New Zealand Transport Agency.

Figure 7

Lowest five average key performance indicator scores, 2018/19

| Key performance indicator | Score and performance level |

|---|---|

| Loss of control in darkness – Statistics for crashes that occur on bends during darkness on the network are decreasing, showing that the contract team understands those assets that have a direct relationship to driving in darkness, and implements effective measures that improve road users’ ability to drive safely. | 2.1 – Minimum Condition of Satisfaction (1.3-2.7) |

| Healthy market pledges – The contract team is consistent and timely in meeting the pledges in its tendered submission, and implements ongoing value-for-money opportunities to ensure that subcontractors have fair access to the market for providing services on the network. | 2.2 – Minimum Condition of Satisfaction (1.3-3.3) |

| Network performance tender pledges are delivered – The contract team is consistent and timely in meeting the network performance pledges in its tendered submission and implements ongoing value-for-money opportunities to deliver services on the network, adding value to the contract’s performance. | 2.3 – Minimum Condition of Satisfaction (1.0-4.0) |

| Innovation – The contract team’s organisational culture actively values innovation, efficiency, and continuous improvement, which it shares across any of the other contracts. Innovation encourages continuous improvement and results in demonstrable benefits. This KPI is intended to encourage an ongoing attitude that activities can be done better. | 2.3 – Minimum Condition of Satisfaction (1.3-4.0) |

| Compliance with contractor’s monthly programme of work – The contract team plans realistic, achievable monthly programmes of work, and consistently delivers the activities as scheduled. | 2.4 – Minimum Condition of Satisfaction (1.0-4.0) |

Source: Office of the Auditor-General, using data from the New Zealand Transport Agency.

2.21

When we looked at the trends for the contract teams against each key performance indicator, we found a similar story. Over time, the contract teams have generally improved their performance against the more compliance- or input-based key performance indicators. However, their performance against the other key performance indicators had generally remained the same or, for some, decreased.

2.22

These results suggest that, overall, the contract teams are delivering acceptable standards of performance as measured by the current key result areas and their associated key performance indicators.

Performance measures and indicators are changing to better reflect their contribution to outcomes

2.23

The Agency’s State Highway Procurement Strategy 2014 stated the main difference between the contracts and previous performance-based contracts is that the key result areas are now better aligned with the outcomes sought by the Agency at a strategic level. In our view, for the intent of the contracts to be fully realised, the measures and indicators in each key result area must enable an overall assessment about performance against the key result area, and enable the Agency to assess the contribution of the contracts to the Agency’s overall outcomes.

2.24

Most of the key result areas are clearly aligned with the outcomes that the Agency is trying to achieve. Some include outcomes-based key performance indicators that provide a clear view on whether the outcome sought through the key result area is being achieved by the contract team. For example, the death and serious injury trends and loss of control in darkness key performance indicators are clearly linked to the road user safety key result area.

2.25

For the network performance key result area, the performance indicators remain largely focused on outputs. Only one of the six key performance indicators, the overall operational performance measure score, includes aspects of road condition. However, we could see a clear link to road condition in only about 15% of the more than 140 operational performance measures that are aggregated under this key performance indicator. In our view, road condition is critical to assessing the network performance key result area, and none of the key performance indicators provide a definitive overall assessment of road condition. Road condition is also critical in understanding how effectively the contracts are contributing to the Agency’s overall outcomes of safe, reliable, and resilient state highways.

2.26

For the latest round of contracts, the Agency is considering including a key performance indicator on network condition under the network performance key result area.

2.27

Across all of the key result areas, many performance indicators are focused on compliance. Seven of the key performance indicators are about whether a contract team has a specific plan (such as a traffic control plan) and is complying with it. As noted in paragraph 2.20, the contract teams, on average, tend to score higher in these key performance indicators.

2.28

We asked staff at the Agency and suppliers, including staff who are part of a contract team, for their views on the current measures. They told us that, in general, the performance indicators do not always encourage the right behaviours and outcomes. They mentioned several reasons for this.

2.29

Suppliers decide what to do based on what they are measured on. This leads them to be more reactive than the Agency would like or to focus on delivering the work programme rather than on the quality of the resurfacing or rehabilitation (renewals). As the Agency’s 2017/18 Looking Back Review Operations and Maintenance Investment Achievement states:

… there are some warning signs that the increased volume of construction activity, may be coming at the expense of construction quality that incurs premature maintenance, especially for Asphaltic Material rehab sites one year after construction.

2.30

Other reasons Agency and supplier staff gave included:

- the key performance indicators are focused on inputs, such as the contract plans, rather than on outcomes;

- the current performance indicators do not recognise continuous improvement (most of the performance score criteria are based on achieving a set level of performance); and

- some operational performance measures are not focused on the right things, which affects the trade-offs that suppliers make to achieve an overall acceptable performance. For example, some suppliers highlighted the amount of effort they spend on clearing litter to meet the relevant operational performance measure, and questioned whether that effort would be better directed towards activities that make the roads safer (such as fixing potholes).

2.31

In our view, the first round of contracts did not fully achieve the intended shift in emphasis from what services a supplier will carry out to what outcomes those services will achieve. For the latest round of contracts, the Agency has made changes to focus indicators more on outcomes. For example, the Agency has removed some of the more compliance-based key performance indicators. This, along with introducing a network condition key performance indicator, should help to provide a better link between the assessed performance of the contract teams and how they are contributing to the Agency’s outcomes of safe, reliable, and resilient state highways.

Benefits from the Network Outcomes Contract model have not been assessed

2.32

The Agency’s State Highway Procurement Strategy 2014 stated that it would complete detailed reviews of how well the Network Outcomes Contract model has worked. The Agency changed to the Network Outcomes Contract model because it believed that it could maintain state highways more effectively and efficiently than it had under previous models.

2.33

The Agency has not yet reviewed the Network Outcomes Contract model and cannot be certain whether it has achieved the benefits it expected. The procurement strategy did not provide any guidance about what the review should cover. We expect that such a review would have allowed the Agency to assess any benefits achieved by the model and how to improve it.

2.34

Not reviewing the model has limited the Agency’s ability to make any changes that are needed to achieve the expected benefits in future contracts.

2.35

In our view, the Agency needs to more systematically monitor the benefits and how they contribute to outcomes. This would provide assurance to Parliament and the public that the contracts are helping to make state highways safe, reliable, and resilient in the most effective and efficient way.

| Recommendation 1 |

|---|

| We recommend that the New Zealand Transport Agency monitor and report on the outcomes and benefits achieved from the Network Outcomes Contracts to help it ensure that the contracts are effectively and efficiently supporting the Agency in achieving safe, resilient, and reliable state highways. |

2.36

During our audit, the Agency formed a Maintenance Contracts Governance Group to help improve its oversight of the delivery of outcomes and benefits for all maintenance contracts, including the contracts. The Agency intends for the Maintenance Contracts Governance Group to prepare an annual report that sets out the outcomes achieved from all of the Agency’s maintenance contracts.

2.37

The Agency also told us that it has now started a review of the contract terms and conditions in collaboration with sector representatives.

Some benefits have been achieved

2.38

Based on our analysis, we consider that the Agency has achieved some of the expected benefits from introducing the Network Outcomes Contract model.

They include:

- reduced spending on routine maintenance activities (see paragraphs 2.41-2.44);

- greater understanding of the need for proposed renewals and a more nationally consistent process to identify and approve those renewals (see paragraphs 2.45-2.52);

- the ability to defer some renewals by changing the process for deciding on renewals (see paragraphs 2.53-2.54); and

- better monitoring and benchmarking of the contracts through consistent performance measures and indicators for the contracts (see paragraphs 2.56-2.67).

2.39

Other benefits include longer-term contracts allowing suppliers and subcontractors to invest more in people and equipment because they know they will have a certain amount of work for the next several years.

2.40

Subcontractors told us that they had also benefited from a better understanding of trends affecting the wider industry and from the larger suppliers transferring knowledge to them. These benefits have come about because of the Agency’s requirement for suppliers to give subcontractors a minimum percentage of work.

Reduced spending on routine maintenance activities

2.41

Agency staff told us that the Agency saved money under the Network Outcomes Contract model because the Agency generally pays a fixed price for routine maintenance rather than a negotiated price based on a schedule of rates.

2.42

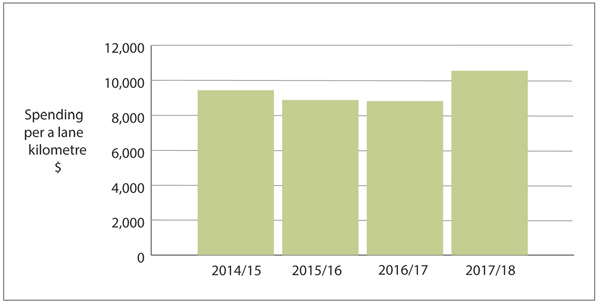

Figure 8 shows that the Agency was able to spend less on routine maintenance for each lane kilometre of state highways in 2015/16 (a total reduction of $12.8 million) and 2016/17 (a total reduction of $14.2 million) than it spent in 2014/15.

Figure 8

Spending on routine maintenance for each lane kilometre of state highways in regions maintained by Network Outcomes Contracts, 2014/15 to 2017/18

The bar graph shows spending of over $9,000 for each lane kilometre in 2014/15, under $9,000 in 2015/16 and 2016/17, and over $10,000 in 2017/18.

Source: Office of the Auditor-General, using data from the New Zealand Transport Agency.

Note: The graph does not include any spending by the Agency’s National Office or in response to the Kaikōura earthquake.

2.43

Overall, the main contributor to this was the Agency spending less in total on sealed pavement maintenance. Compared with 2014/15, the Agency spent about $17.8 million less in 2015/16, $22.7 million less in 2016/17, and $7.7 million less in 2017/18.

2.44

However, in 2017/18, the Agency spent more (about $25.3 million more compared with 2014/15). The main contributor to this was network and asset management, including network inspections, managing the road network, and implementing and operating road asset management systems. The Agency spent about $19 million more on this in 2017/18 than it did in 2014/15. The other significant increase was in environmental maintenance, such as maintaining rest areas, collecting litter, and clearing slips.

Stronger process to decide the renewals work programme

2.45

In 2013, the Agency changed its process for deciding the renewals work programme. The new process plans renewals nationally and delivers them regionally, with the Agency centralising funding decisions. The Agency made this change to have greater financial control over the timing and type of renewals, in an effort to ensure that they were done at the right time, in the right place.

2.46

The previous model involved Network Management consultants proposing regional programmes and Area Managers working closely with the consultants to finalise them. The new process has led to a more nationally consistent prioritisation of work, and the Agency has a greater understanding of the need for renewals.

2.47

Under the new process, the contract team is responsible for preparing work programmes of renewals that are aligned with the contract team’s Maintenance Management Plan7 and instructions from the Agency.

2.48

There are two main work programmes for renewals. The first is produced every three years, in line with the Agency’s funding cycle. This is a three-year plus seven-year programme (that is, an overall 10-year programme), which the Agency uses to help prepare its National Land Transport Programme for each three-year period.

2.49

The second main work programme is produced each year. It is an annual plan to deliver the approved in-principle three-year programme and update the forecast 10-year programme.

2.50

Once the draft work programmes have been completed, staff from the Agency and the contract teams jointly inspect the proposed sites for renewals. This is so both parties agree on when the renewal needs to happen and on the appropriate treatment.

2.51

After the contract teams and the Agency agree on the work programmes at the contract level, the work programmes are submitted for consideration and, subject to prioritisation of available funding, approval from the Agency at the national level. Agency staff and contract teams might be asked for more information to justify the level of investment they have asked for.8

2.52

These changes have provided the Agency with a greater understanding of the need for proposed renewals, and led to a more nationally consistent process to identify and approve those renewals. However, at times, the changes have led to delays in decision-making. These delays have adversely affected the contract teams (see paragraphs 4.24-4.27), such as affecting their ability to secure the necessary resources and contractors to deliver the work programme.

2.53

The change in the process for deciding renewals also allowed the Agency to initially defer a significant amount of renewal work. Nationally, the Agency was able to defer the renewal of 281 kilometres of state highways in 2014/15, 146 kilometres in 2015/16, and 36 kilometres in 2017/18.

2.54

This is reflected in our analysis of the Agency’s renewal spending in the regions maintained under the contracts. We estimate that the Agency spent about $23.9 million less on all renewals in 2015/16 than in 2014/15, and $10.5 million less in 2016/17. Renewal spending then increased by $37.2 million in 2017/18 compared with 2014/15.

2.55

In our view, the changes the Agency made to strengthen the process to decide when to resurface and rehabilitate state highways make sense, and should ensure that its investment is well targeted. The Agency told us that the previous approach was leading to over investment in renewing highways (that is, renewal work was carried out earlier than it needed to be). Well-targeted renewals are important because the Agency has a number of pressures it needs to balance, including maintaining an increasingly larger and more complex network with limited funding.

Performance information can now support continuous improvement

2.56

Despite limitations in the contracts’ performance measures and indicators, having consistent performance measures and indicators for all contracts means that the Agency can now analyse performance information at a national level to support continuous improvements in maintaining state highways.

2.57

Previously, the Agency used several different types of maintenance contracts, each with its own performance measures and indicators. This made it difficult for the Agency to systematically or consistently assess information at a national level or to benchmark contractor performance.

2.58

With the contracts, the Agency introduced a consistent set of performance measures and indicators. This has allowed it to benchmark the performance of contract teams, track progress over time, identify issues, and provide feedback to contract teams on what they need to improve.

2.59

The Agency’s performance assessment process relies on contract teams to report on and audit their performance. There is a moderation process to ensure national consistency. The measures and indicators used to assess the contract teams’ performance include operational performance measures and key result areas with several associated key performance indicators.

2.60

Each operational performance measure is the contract standard that the Agency expects contract teams to maintain for each asset (such as roads, marker posts, and signs) and road class.

2.61

There are more than 140 operational performance measures, including measuring the amount of litter on the side of the road, the visibility of signs, and the number of potholes. Contract teams audit their performance against these measures. The audit frequency varies for each measure, but each contract team is required to report on its performance against the operational performance measures monthly.

2.62

Every four months, each contract team assesses its performance against the key result areas and associated key performance indicators. Self-assessments are based on guidance provided by the Agency and each contract team’s Quality Management Plan. The Contract Management Teams and the Contract Boards (see the Appendix) review the self-assessment and associated evidence, and the contract team’s scores against the key result areas and its overall performance level are endorsed.

2.63

In 2015/16, the Agency introduced a moderation process to help ensure that self-assessment scores are consistently applied to all contract teams. The moderation process is run by the Agency’s Planning and Performance Team and involves selected Agency regional staff (outside of the Planning and Performance Team). Part of the moderation process could include asking contract teams for further information or explanation. For the performance assessment periods from 2015/16 to 2018/19, the moderation process resulted in changes to about 10% of the endorsed scores. These changes were mostly decreases.

2.64

At the end of each year, an overall annual performance score for each contract team is calculated based on the moderated key result area scores for each

four-month period. The moderation process helps the Agency to assess the contract teams impartially, so that similar performance is treated similarly.

2.65

The main incentives to encourage contract performance include an at-risk payment for performance against the operational performance measures, incentive payments, and decreases or increases in the length of the contract depending on the overall annual performance score. The incentives encourage good performance against the operational performance measures and the key result areas.

2.66

However, the incentives and penalties under the contract can also lead to unintended consequences. For example, the incentive of sharing savings from the reduced programme of renewals could lead to contract teams proposing fewer renewals than are needed to maintain the condition of the state highways.

2.67

By introducing consistent performance measures and indicators, the Agency can now analyse performance information to support continuous improvement in maintaining state highways. However, we identified issues with the current moderation process that cause frustration and tension, which the Agency could usefully consider (see paragraphs 4.28 to 4.35).

Trade-offs have been made in achieving these benefits

2.68

Importantly, the Agency has made some trade-offs to achieve these benefits. To manage the associated risks from these trade-offs, the Agency needs to monitor them. The Agency would be able to use the information it gathers while monitoring those risks to make decisions about realising further benefits and weigh those against the costs of doing so.

2.69

Initially, some suppliers put in low tenders for the contracts that, in hindsight, did not necessarily reflect the work needed – for example, in setting up and administering the contract. This is known as under-tendering. Although

under-tendering resulted in reduced costs for the Agency, it might have encouraged suppliers through their contract teams to focus on reducing costs rather than on what is best value for money to maintain the network. Under-tendering could also have a significant negative effect on the relationship between the Agency and the supplier.

2.70

In 2015/16, the Agency changed its procurement method from suppliers nominating a price (called the “price quality method”) to the Agency setting the price for tenders (called “purchaser nominated price”) to reduce the risk of suppliers under-tendering for the contracts.

2.71

We looked at the contract teams’ relationship survey results to better understand how under-tendering affected relationships in the contract teams. For 2018/19, we found contracts that used the “purchaser nominated price” had either the same or better average scores than contracts that used the “price quality method”.

2.72

Other trade-offs include:

- deferring renewals, which might be appropriate but could create a long-term risk to the condition of state highways (see paragraphs 3.7 to 3.23);

- some performance measures and indicators encouraging behaviours contrary to the Agency’s expectations – for example, Agency staff told us that some suppliers are not doing as much preventative maintenance as they should because they are focusing on reactive maintenance to meet performance measures; and

- a loss of technical expertise because of changes in the role of consultants. For example, consultants used to be responsible for asset management and managing contractors. Now these roles have been spilt between the Agency and suppliers. To reduce costs, the level of resourcing changed. However, this came at a cost to the level of capability available to suppliers and the Agency.

2.73

The Agency has taken steps to reduce the adverse effects of these decisions. For example, in the latest round of contracts, the Agency had clearer requirements for suppliers to demonstrate that they have access to the technical expertise that consultants used to provide.

6: A score of 1 to less than 2 is poor, 2 to less than 2.66 is the minimum condition of satisfaction, 2.66 to less than 3.33 is best practice, and 3.33 or more is outstanding.

7: The contract teams prepare a Maintenance Management Plan for each contract. Agency staff then review and agree the plan to check that it aligns with the Agency’s expectations and goals. The contract teams are guided by the plan in deciding what work is to be done and when. The plan outlines the factors, procedures, and processes the contract teams use to decide what maintenance and renewal work is to be done and when. For example, to decide whether a section of road needs to be resealed, the contract teams need to analyse condition, pavement, maintenance activity, and traffic data.

8: The other significant work programmes done under the contracts are to reduce the roughness of state highways and to increase skid resistance. Similar to the annual plan, the contract teams analyse Agency-supplied data to identify potential sites for work and submit them to the Agency for approval. The Agency then reviews and approves the work programme as appropriate.