Headlines from the audits

Audit opinions

1.1

We issued 24 unmodified audit opinions, which means that the financial statements are a fair reflection of the position for those 24 tertiary education institutions (TEIs) at year-end and of their activities during the year.

1.2

We did not issue audit opinions (or audit reports) for Tai Poutini Polytechnic, Wellington Institute of Technology (WelTec), and Whitireia Community Polytechnic. This was because Tai Poutini’s Crown Manager, and WelTec and Whitireia’s Crown Commissioner, could not sign a statement of responsibility for the financial statements, which had been prepared on a “going concern” basis. Both were awaiting the outcome of a decision by the Government on whether to provide additional funding.

1.3

An organisation that is a going concern is assumed to have enough money to pay its bills as they fall due for the “foreseeable future”. As a guideline, this will be for at least a year after the date of the audit opinion.

1.4

In Tai Poutini’s case, it could not produce cash flow forecasts far enough into the future. After the financial year-end, the Government provided extra funding of $2.25 million for Tai Poutini to meet its obligations until 1 April 2020.

1.5

Although they are separate institutions, WelTec and Whitireia have shared management and governance roles. Their cash flow forecasts did not support using the going concern basis. WelTec was in a stronger position, but it was potentially exposed if Whitireia could not make loan repayments or realise its share of cost savings.

1.6

As at 25 November 2019, the Government had not confirmed extra funding for WelTec or Whitireia.

1.7

Although we issued unmodified audit opinions, we included an “emphasis of matter” paragraph in the audit reports of the 13 institutes of technology and polytechnics (ITPs) that reported. These paragraphs drew attention to the disclosures in the financial statements about the uncertainty arising from the Government’s proposed reforms of vocational education. We discuss those reforms on pages 11-12.

Additional assurance work at Wintec

1.8

The Chairman of Waikato Institute of Technology (Wintec) asked us to carry out additional assurance work about certain international travel expenses incurred by the Chief Executive, and past and present members of the executive team. We also reviewed all redundancy and severance payments made to former Wintec employees from 2013 to 2017.

1.9

A public organisation must be able to show what it is spending money on and that any expenditure is justified, reasonable, and appropriate in the circumstances. Sensitive expenditure, where there is a perceived potential for private benefit, should be conservative and moderate. There also needs to be transparent and robust processes for approving expenditure.

1.10

In both areas we tested, we identified incomplete and inaccurate records of the expenditure, and numerous instances where the expenditure had not been properly approved. As a result, in many cases, Wintec was unable to provide an account of how it had spent public money. This is unacceptable for a public organisation charged with the stewardship of public resources.

1.11

We were particularly concerned about the processes, patterns of behaviour, and level of documentation that we saw in our work on international travel expenditure. Some of these practices do not meet standards acceptable in the public sector and provide an increased opportunity for the misuse of public money. You can read our full report here.

Timeliness of reporting

1.12

All 24 TEIs that reported met their statutory reporting deadline.

Preparation for audit

1.13

Although a high proportion of TEIs meet their statutory reporting deadlines, there can be hidden costs in meeting the deadlines. These costs are not just financial – they can include extra stress on TEI staff and on the audit teams.

1.14

TEIs can do much to ensure that the audit process runs smoothly. Robust governance frameworks and internal controls are vital to good stewardship of organisations and in maintaining public trust and confidence. When they are operating effectively, these frameworks and controls can reduce the amount of work auditors need to carry out.

1.15

Preparation for the audit process is also important. Some common issues faced by our auditors this year included:

- auditors not being able to rely on the internal controls, and the TEIs not having all the required information available at the start of the process;

- lack of internal quality review of the annual report (including the financial statements and statements of service performance), relying on the auditors to find errors;

- auditors receiving multiple iterations of the financial statements; and

- TEIs not including enough disclosures in their reporting to explain certain figures.

1.16

This year, we approved 11 requests from auditors wanting to charge additional costs to TEIs because of delays and rework caused by the TEIs (and two other requests relating to subsidiary company audits).

1.17

In 2019 and 2020, we intend to work more closely with the senior managers, and Audit and Risk Committees, of some TEIs to help them understand how their oversight can contribute to an improved audit process.

Our assessment of the effectiveness of systems and controls

1.18

We have already highlighted the importance of effective systems of control and good governance. Our auditors add value to the organisations they audit and strengthen public accountability by pointing out improvements to increase the effective operation of those frameworks and controls.

1.19

Our auditors made 126 new recommendations for improvement resulting from their work on the 2018 audits of TEIs.

1.20

TEIs addressed 115 recommendations from previous years, but 165 remained open – making a total of 291 open recommendations.

1.21

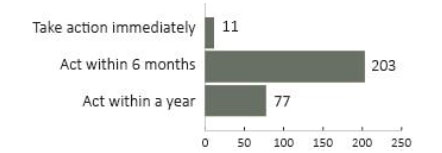

Figure 1 shows the status of all open recommendations at 30 April 2019. When making recommendations, our auditors indicate the seriousness of the matter by indicating how quickly TEIs should act. We expect TEIs to have cleared all of the recommendations by the time of the next audit, but some recommendations will need an urgent response.

1.22

Of the 11 “take action immediately” recommendations in Figure 1, 10 were from previous years.1 The University of Otago had five of these recommendations, including reinstating an internal audit function (in-house or outsourced), managing conflicts of interest in procurement, and having all journal transactions independently reviewed. Auckland University of Technology, Massey University, Ara Institute of Canterbury, the Eastern Institute of Technology (EIT), and Otago Polytechnic had one outstanding urgent recommendation each.

Figure 1

Open recommendations at 30 April 2019, by relative urgency for action

Source: Auditors’ reports to the councils of TEIs.

1.23

The top four categories of recommendation our auditors made in 2018 were for TEIs to improve:

- controls related to expenditure, including payroll systems;

- how they applied accounting policies, or adhered with the TEI’s own policy framework (such as spending on travel);

- how well the TEI’s annual report tells interested audiences about how it is performing; and

- information technology systems and controls (such as security and preventing over-rides of rules).

1.24

In 2020, we intend to engage more frequently with the Audit and Risk Committees of those TEIs with the highest number of outstanding recommendations. In our view, those Audit and Risk Committees should be more rigorous in following up on progress in addressing our recommendations.

1: We know some TEIs have acted on some of these recommendations, but we will assess that progress in the 2019 audit.