Part 3: Matters we identified from our audits

3.1

In this Part, we set out matters from the 2016 school audits that we consider important enough to bring to the Secretary for Education’s attention.

Quality of school financial statements

3.2

For the 2016 school audits, the Ministry provided better guidance to schools in a more timely manner. This included providing the 2016 Kiwi Park model financial statements to schools earlier than in previous years. The sector working group attended by representatives of the Office of the Auditor-General is working well and helping to improve the guidance available to schools.

3.3

Our auditors are still finding that, despite the quality of draft financial statements presented for audit significantly improving for 2016, many schools are not able to prepare statements of cash flows accurately. Although the 2016 Kiwi Park model includes more guidance than previously, schools rely too heavily on the worksheets in the Kiwi Park model and lack an understanding of the principles underlying the cash flow statement.

3.4

To prepare for the 2017 audits, the Ministry has responded to the recommendations set out in our letter about the results of the 2015 school audits:

- The Ministry has recently updated its Financial Information for Schools Handbook. This supplements other guidance incorporated into the Kiwi Park School model.

- For 2017, Kiwi Park Group model financial statements are available on the Ministry’s website, alongside the updated Kiwi Park School model financial statements for 2017.

3.5

These responses should continue to improve the quality of school financial statements.

3.6

We are also pleased to see the Ministry repeating its Kiwi Park regional workshops this year to help schools and service providers use the model effectively. We suggest that the Ministry consider providing Tier 1 Kiwi Park model financial statements for 2018, because we expect that more schools will have to report at Tier 1 from 2017 onwards.

| Recommendation |

|---|

| We recommend that the Ministry provide further guidance and training to schools on preparing a statement of cash flows. |

School audit “pipeline”

3.7

Even though the Ministry provided the Kiwi Park model financial statements earlier than in previous years and has improved its guidance to schools, many schools still missed the statutory deadline. This year, 460 school audits missed the statutory deadline. We expect only 5% (about 120 audits) to do so. Although nearly half of audits that missed the deadline (216) had been completed by the end of June, the “tail” of audit arrears continues to grow, as shown in Figure 1.

3.8

Although more schools provided draft financial statements for audit by the deadline of 31 March 2016 than in the previous year, the auditors received most of these at the end of March. Before 2012 and Novopay, auditors would get draft financial statements throughout February and March, which allowed them to spread their workloads. The inability to start audits as early as they would normally start causes a bottleneck at the end of May, putting pressure on schools, financial service providers, and auditors.

3.9

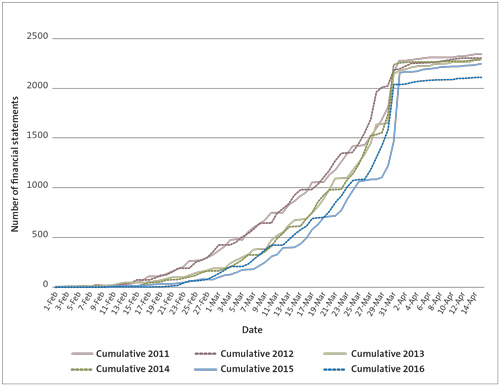

Figure 2 shows the dates that auditors received draft financial statements for audit for the last six years. The last “normal” year before Novopay was 2011. Figure 2 shows that the date when auditors receive draft financial statements has moved, with auditors receiving almost a thousand sets of draft financial statements for the 2016 audits in the last week of March.

Figure 2

Date on which draft financial statements were provided for audit

3.10

We are working with the Ministry to understand the reasons for this change, because this is only partly attributable to changes in payroll reporting. We are considering what we can do to streamline the process for schools and auditors for the 2017 audits.

3.11

Because of the issues with payroll reporting during the past five years and the new accounting standards in 2015, we have had to accept many schools missing the statutory deadline. Where it was because of circumstances outside the school’s control, we relaxed the requirement to disclose the breach. We are now dealing with apathy from some schools about the statutory deadline. Getting schools to recognise the importance of timely accountability is an ongoing challenge.

School payroll reporting

3.12

There were no changes to payroll reporting for 2016. Schools still needed the error reports created outside Novopay, as well as Novopay’s annual payroll report (the SAAR), to complete their financial statements. Schools also needed the leave liability reports for non-teaching staff, which are also produced outside Novopay.

3.13

Because this has had a significant effect on the school audits, we recommended last year that the Ministry:

- ensure that there is a clear understanding of the roles and responsibilities of all the parties involved in the payroll process;

- make enough resource available to meet the set time frames, including adequate time for the Ministry’s internal quality assurance processes; and

- encourage schools to prepare draft financial statements when they receive the SAAR.

3.14

It was helpful to have one main point of contact at the Ministry for payroll matters. However, we again experienced several delays and identified errors in the payroll reporting for the 2016 audits.

3.15

We agree a timetable with the Ministry and Education Payroll Limited for producing and delivering the SAAR and error reports. Our appointed auditor of the Ministry, carries out testing of these reports before the Ministry sends them to schools and auditors. Because the timing of the payroll reports affects the ability of our auditors to complete their audits, we again asked the Ministry to provide the payroll reports as early as possible.

3.16

The Ministry released the SAAR in accordance with the agreed timetable on 13 February. However, the Ministry did not send error reports to schools until 8 March, later than the planned date of 27 February. Auditors did not get their copy of the reports until 29 March (which were planned to be sent by 28 February).

3.17

Education Payroll Limited produces the leave liability and error reports manually using data from Novopay. This means that the reports are more susceptible to error and that we continue to find errors in the reports. For 2016, the overpayments reported to many schools were wrong, and a replacement report was issued to those schools at the end of March.

3.18

Funding code errors occur because payments are coded against the wrong funding stream in Novopay. This results in schools owing money to the Ministry for payments made from the Teachers’ Salaries Grant instead of the schools operating grant, and the other way around. The Ministry has not agreed to settle these errors, and the receivables and payables have continued to increase since the start of Novopay.

3.19

However, schools told us that some of these amounts were settled during 2015 and 2016. These payments were not reflected in the funding code error reports. We also found that no formal process or record of payments was made. As a result, we could not provide assurance to school auditors on the completeness of the funding code error reports, which meant that some school auditors needed to carry out further procedures.

3.20

If we identify errors in the payroll reports, we must carry out further audit work, and the report often has to be rerun. This can cause delays. However, the part of the school payroll reporting process that causes problems each year is splitting the error reports into individual reports so the Ministry can send them to each school. The Ministry needs to ensure that it has the capability and capacity to do this if it is to meet the agreed timetable.

3.21

We understand that the time frames for sending payroll reports to schools are not likely to change significantly for the 2017 audits, because there have been no significant changes to the control environment within Education Payroll Services Limited. Therefore, our audit approach will not change. However, we are considering, in consultation with the Ministry, whether we can carry out more work on the pre-year-end reports to speed up the delivery of reports to schools and auditors.

3.22

As the level and amount of errors reduce, we find that many of the payroll errors are not material. The message to schools continues to be that they should be able to complete their draft financial statements after getting the SAAR at the beginning of February. Any errors in the error reports can be treated as audit adjustments if necessary. We are working with the Ministry on some data to support this assertion so it can send the necessary communication to schools. This should help auditors to get draft financial statements earlier and improve audit timeliness.

| Recommendation |

|---|

For the 2017 school audits, we recommend that the Ministry:

|

Resource Teacher: Learning & Behaviour (RTLB) clusters

3.23

During the 2016 audits, we looked into the governance of Resource Teacher: Learning & Behaviour (RTLB) clusters in more detail because we were considering how to account for TELA leases (which are laptop leases for principals and teachers) for RTLB teachers. On reviewing the underlying Memorandum of Agreement for these clusters, it became clear that the lead school is the governing body for the RTLB cluster and not an agent, as we thought.

3.24

We also became aware that many RTLB clusters own assets that are not shown on any school’s balance sheet. Because of this and the significant size of some of the clusters, we decided that the note disclosures in the model financial statements were not enough.

3.25

For 2016, the Ministry asked RTLB lead schools to add some disclosures to their financial statements about the cluster. We agreed that it was too late in the audit process to make significant changes to reporting requirements. However, for 2017, the Ministry will ask lead schools to report on the RTLB clusters separately. We understand that the Ministry is developing the reporting template, which it will share with us. Once we are clear on the reporting requirements, we will consider the audit arrangements.

3.26

We are aware that schools are involved in other activities, including activity centres, Communities of Learning, and other cluster arrangements. There is no guidance for schools on how to account for these separate activities. The reporting requirements usually depend on whether the school board is in a governance position or acting as an agent.

3.27

Without clear guidance, there is a risk that schools are accounting for these other activities inconsistently. When the Ministry puts new arrangements in place, such as Communities of Learning, it needs to consider how schools are to be accountable for the funds they receive. The Ministry needs to ensure that it reviews the reporting requirements regularly because these informal arrangements often evolve over time.

| Recommendation |

|---|

We recommend that the Ministry:

|

Kura kaupapa Māori

3.28

We continue to raise concerns about financial management and the appropriateness of spending in some kura. Examples of this can be found in Part 2. Appendices 1 and 2 show many kura on our arrears lists. The 2016 audits of 17 kura (23% of kura) remain outstanding, and six of these have prior-year audits also outstanding, some of which are for multiple years.

3.29

In Part 6 of our report, Education sector: Results of the 2010/11 audits, we reported on a review we had carried out of financial management of kura kaupapa Māori. Our work found that the policies and practices in about 20% of kura did not reflect best practice. We recommended that the Ministry monitor how effectively kura and other small schools follow its guidance and, if necessary, provide more targeted guidance.

3.30

In our report on the results of the 2012 school audits, published in May 2014, we included a follow up of our earlier work. The Ministry told us that it planned to issue model financial management policies in 2014 and was working with two external organisations to put support and training in place for kura later in 2014. We would appreciate an update on the Ministry’s support and guidance for kura.

School annual reports

3.31

Under the new auditing standards, auditors must refer in their audit reports to the “other information” that they are required to review as part of the audit. The Education Act 1989 and the Ministry specify that schools must include the following “other information” in their Annual Reports:

- analysis of variance;

- list of trustees;

- statement of responsibility; and

- statement of Kiwisport funding.

3.32

For the 2016 audits, many auditors found that not all of these documents were available when they were ready to sign the audit report. Also, many schools do not produce an Annual Report with consecutively numbered pages. Because of this, many auditors had concerns about whether the version of a document they reviewed as part of the audit was the final document that the school reported.

3.33

Under the recent update to the Education Act 1989, schools must now make their Annual Reports available on their websites. Although the Ministry has told schools about this change, there has been no guidance about how schools should present their Annual Reports.

3.34

We have told our auditors to ensure that schools provide the version of the documents they intend to publish on their website for review before the audit is signed off. It would be useful if the Ministry also gave this message to schools. We have also been told that some small schools do not yet have a website.

| Recommendation |

|---|

We recommend that the Ministry provide guidance to schools on preparing their Annual Report, including:

|

Sensitive payments

3.35

As noted in Part 2, our auditors told us about several instances of schools giving gifts to principals on their retirement. We were told about some other gifts as well as the three payments we referred to in Part 2. Because the amounts involved were not as large, we referred to these in the school’s management letter rather than the audit report.

3.36

Although a gift for a long-serving employee is not unreasonable, we considered that the amounts involved were unreasonable. In many of these instances, schools had a policy about gifts but had not approved payments consistent with their policy.

3.37

Auditors also told us about some significant settlement payments to employees, trustees, or committee members during the year. If a school has followed the correct procedure when an employment dispute occurs, including getting appropriate advice and ensuring that the settlement agreement is clear, we do not comment on the amount agreed.

3.38

However, the number of large settlements may indicate that boards need more guidance on employment matters. We also identified settlement agreements that were ambiguous because either the school did not know how much it had agreed to pay or the school did not understand how it should pay the settlement.

| Recommendation |

|---|

We recommend that the Ministry:

|

Fraud

3.39

We ask our auditors to report any actual or suspected fraud that they identify or are told about during their audits. Auditors told us about several relatively small incidents of fraud this year where the school decided not to tell the relevant law enforcement agency. The school often did not tell the Ministry about these either. In these instances, the employee paid back the amounts in question, and the school dismissed the employee. However, we are aware that some of these employees then moved to other schools.

3.40

Fraud in schools often happens because duties are not sufficiently segregated. We ask our auditors to raise this as a risk in school management letters, even if it is difficult for a small school to correct this. We also stress the importance of a fraud policy and showing employees that there are consequences for committing fraud. We have also written to the Ministry directly about schools about which we have identified concerns.

3.41

It is encouraging to see the Ministry’s new risk assessment tool that targets those schools most in need of help. Although this cannot prevent fraud, we hope that it will help to raise awareness of good controls and financial governance. We will continue to share information with the Ministry when our auditors raise significant concerns about schools.

| Recommendation |

|---|

We recommend that the Ministry:

|

Leases

Leasing school equipment

3.42

For the 2016 audits, the Ministry provided guidance to schools on how to classify and record leases in their financial statements. However, our auditors found that some schools still struggled with the accounting and getting the necessary information.

3.43

After a review of the accounting treatment under the new standards, we agreed with the Ministry that TELA leases are finance leases. The guidance the Ministry provided was comprehensive, which helped schools make the change for their 2016 financial statements. Some schools struggled in this first year of transition because of the amount of leases. Schools needed to consider the classification of existing as well as new leases. If schools record these leases correctly as finance leases from the beginning, they should not experience the same issues for the 2017 audits.

3.44

We continue to have concerns about the value for money of some of the copier and other equipment contracts that schools enter into. We still see agreements that include large settlement payments to buy the school out of previous contracts, significant commitments for service and consumables, and companies offering schools “donations” as incentives. It is not always clear that schools understand what they have signed up for and whether they followed the proper delegations.

3.45

We have also seen schools that have upgraded their equipment and added the outstanding lease payments on the old lease to the new lease. The school is then paying for the old equipment it no longer has as well as the new. For copiers, because the school is usually paying a “per copy” charge, what the school is actually paying for is not always clear.

3.46

In our view, guidance on considering the value for money of lease agreements and the implications on the school’s borrowing limits of entering into finance leases would be useful. We saw an increase in schools breaching the borrowing limit from 33 last year to 41 this year, because TELA leases are now considered to be borrowing. Because schools need more equipment to keep pace with the digital curriculum, the decision to lease or buy has become more commonplace for schools.

Schools leasing IT equipment to students

3.47

Because of NZQA’s intentions to allow students to complete most NCEA examinations online by 2020, schools need to consider how they can provide access for their students to the necessary equipment. We raised the issue of schools leasing equipment to students, which the Ministry considers a breach of legislation, in our letter to the Secretary for Education last year.

3.48

During the 2016 audits, we were told about a school entering into an arrangement with a third party to allow parents and caregivers access to a device for their children. This includes the school paying an administration fee to the third party.

3.49

Although the arrangement did not breach legislation, it is not without risk. The Ministry has confirmed that it considers this to be a suitable use of schools funds and that the school in question consulted with the Ministry.

3.50

However, we expect school boards to fully consider the arrangement, whether the amounts involved are appropriate, and any potential financial or other risks to the school before entering into such an arrangement. There is a risk that schools will consider such arrangements to be “approved” by the Ministry and not carry out the necessary due diligence before entering into one.

3.51

The Ministry has provided no further guidance to schools on this. The Secretary for Education’s response to our letter last year stated that there would be guidance on this by the end of the first quarter of 2017. Our auditors will continue to raise concerns about these arrangements in schools’ management letters.

| Recommendation |

|---|

We recommend that the Ministry:

|

State-integrated schools

3.52

We have raised concerns in the past about state-integrated schools because of the close relationship between the proprietor and the school. Although these are only a small minority of schools, we still see instances where either schools do not make clear who they are collecting donations for or boards collect donations for the school and pass these to the proprietor.

3.53

We also continue to see clear conflicts of interest where proprietor representatives take part in the decision for the proprietor to keep these funds. Of concern is that, when we raise this issue, the proprietor representatives do not consider it to be a conflict.

3.54

Last year, we recommended that the Ministry remind state-integrated schools of their obligations about public money in its update to the guidance on payments by parents. The Secretary for Education’s response to our letter said that the Ministry would make more guidance available to boards of state-integrated schools by mid-December 2016. We would appreciate an update on this guidance.

3.55

The Association of Integrated Schools has updated its guidance on fundraising to proprietors recently. However, its new manual, Handbook for a Proprietor of a State-Integrated School, does not cover conflicts of interest.

3.56

Another issue that has arisen in some schools this year is proprietors’ agreeing to provide funds to the school after the year ends, so the school does not report a deficit. Historically, these funds have been recognised as a receivable.

3.57

Although the proprietor may have told the school it would provide some funding, there was no formal agreement about how much the proprietor would give to the school. Because no binding agreement was in place as at 31 December, the school does not have a receivable at that date. Without an agreement, any funds received are accounted for as a donation when received. How such an amount is accounted for may affect the going concern status of the school, because the funds might be needed for the school to pay its outstanding bills at balance date.

3.58

We have identified this issue only in a handful of schools, but we will ask our auditors to look out for this in the 2017 audits.

| Recommendation |

|---|

| We recommend that the Ministry consider providing guidance about conflicts of interests, in consultation with the Association of State Integrated Schools. |

Cyclical maintenance

3.59

Our auditors are still finding cyclical maintenance a challenging area to audit because many schools do not understand the provision and do not have the necessary information to calculate the provision accurately.

3.60

The new 10-year planning process is producing better quality plans, which include maintenance plans. However, because boards delegate this to a property planner, they may not take the time to fully understand the plans. The actual maintenance a school plans to carry out can be different to that set out in the 10-year property plan.

3.61

Even when the 10-year property plan is up to date and agreed by the board, schools often do not understand how to translate this into a cyclical maintenance provision. The template for calculating the provision is no longer on the Ministry’s website.

3.62

The Ministry needs to provide further guidance on how to translate the plan into a provision. Although we qualified the opinions of only three schools because we could not get enough assurance about the cyclical maintenance provision, this area takes a considerable amount of audit time.

| Recommendation |

|---|

| We recommend that the Ministry provide further practical guidance on calculating cyclical maintenance provisions and put the template for calculating the provision back on the Ministry’s website. |

Board contributions to capital works

3.63

The Ministry’s policy has been that a school can capitalise a contribution to a Ministry capital works project only if it has Ministry approval, otherwise it should be an expense. We understand that this is a policy position to prevent schools building assets without permission. However, whether or not such contributions should be expensed depends on the underlying circumstances.

3.64

Although the Ministry has updated its guidance on this on its website, we consider that it still needs further clarification. There are several different scenarios, such as schools contributing funds for a part ownership of a building, contributing funds to upgrade the fit-out, and providing funds to the Ministry (often raised by the community) for a building that they no longer wish to have any responsibility for.

3.65

Using the current guidance, it is not always clear what the correct treatment is in each scenario. It would be useful for the Ministry to confirm the accounting treatment for these contributions when it agrees the project with the school.

3.66

We are working with the Ministry on the correct accounting treatment for the different scenarios where school funds are used to build or improve a building where the school will have no ongoing ownership interest.

| Recommendation |

|---|

We recommend that the Ministry:

|

Closed and merging schools

3.67

The Secretary for Education signalled to us last year that updated guidance for residual managers on the financial reporting requirements of closed and merging schools would be available by mid-2017. We have not seen this updated guidance.

3.68

We continue to see a lack of clarity about the financial reporting requirements for merging schools, especially when they merge during a school year. As soon as a school has been told it is merging, a decision should be made on how it must prepare its financial statements in the year of merger. Our experience has been that our auditors have to work this out with the school once the financial statements are due. This usually significantly delays the audit.

| Recommendation |

|---|

| We recommend that the Ministry provide updated guidance on financial reporting for closed and merging schools for residual managers. |

Update on previous recommendations and issues raised with the Ministry

3.69

In Appendix 5, we provide an update on the recommendations we raised in our letter to the Secretary for Education about the results of the 2015 audits that we have not covered in this report.

3.70

In our report on the results of the 2012 school audits published in May 2014, we commented on some work we had done in previous years. Although this was several years ago, some of these issues are still relevant. We would appreciate an update on how the Ministry has progressed against the issues raised. Matters relating to property funding for, and payments to principals by proprietors of, state-integrated schools are also set out in the appendix.