Part 2: Changes in accounting standards for the public sector

2.1

In this Part, we summarise how accounting standards and financial reporting in the public sector changed from 1993 to 2009. We also set out the concerns that we and others expressed in 2009 about using accounting standards that were not suitable for much of the public sector.

Changes in accounting standards from 1993 to 2009

2.2

In 2009, the then Auditor-General, Kevin Brady, published a discussion paper to make Parliament aware of our concerns about accounting standards for the public sector.2 These concerns arose because of the way that accounting standards had been changing since 1993.

2.3

Figure 3 shows the main changes in accounting standards from 1993 to 2009.

How accounting standards were set from 1993 until late 2002

2.4

In 1993, the Accounting Standards Review Board was set up as an independent Crown entity. It had limited resources and functions, and its part-time members met only a few times each year. One of its main functions was to review and approve accounting standards.

2.5

From 1993 to 2002, the Financial Reporting Standards Board, a committee of the then New Zealand Institute of Chartered Accountants,3 wrote the accounting standards.4

2.6

The Accounting Standards Review Board approved accounting standards proposed by the Financial Reporting Standards Board, as it saw fit, for specified reporting entities to apply when preparing general purpose financial reports. Accounting standards approved by the Accounting Standards Review Board had legal status. Therefore, the two Boards had to co-operate to set accounting standards.

2.7

The accounting standards that were created, known as Financial Reporting Standards, took into account the nature of the different entities that would apply the standards. That is, when determining the requirements of Financial Reporting Standards, the standard-setters took account of the different type of entities in the public sector, the not-for-profit sector, and the private sector, regardless of size.

2.8

Taking account of a broad range of entities meant thinking about a broad range of transactions and a broad range of information needs for the users of general purpose financial reports.

Figure 3

Timeline of the development of accounting standards in New Zealand, 1993 to 2009

2.9

As well as taking account of the broad range of entities, Financial Reporting Standards were typically written using language that was appropriate for all reporting entities, whether they were in the public, not-for-profit, or private sectors. These standards could fairly be described as "sector neutral" because they were written with the full range of entities in mind.

Decision in late 2002 to introduce International Financial Reporting Standards

2.10

In December 2002, the Accounting Standards Review Board decided that all reporting entities in the public and private sectors would apply new accounting standards based on International Financial Reporting Standards (IFRS).

2.11

The International Accounting Standards Board designed IFRS to improve profit-oriented entities' access to international capital markets. Financial statements prepared in different jurisdictions would be directly comparable because they would use the same set of accounting standards.

2.12

IFRS were first adopted by entities with financial reporting obligations listed on the European stock exchanges and entities subject to the Australian Corporations Act 2001, for reporting periods beginning on or after 1 January 2005.

2.13

When New Zealand adopted accounting standards based on IFRS, some limited changes were made to IFRS. The adapted standards were called New Zealand equivalents to International Financial Reporting Standards (NZ IFRS). Like Australia, New Zealand applied its IFRS-based accounting standards to all reporting entities, including public benefit entities, rather than only to profit-oriented entities listed on stock exchanges.

2.14

The initial view of the Accounting Standards Review Board was to adapt IFRS for reporting entities in the for-profit sector, the public sector, and the not-for-profit sector. However, because of concerns that changes to IFRS could compromise its integrity, including how the standards might be interpreted, the Accounting Standards Review Board decided to limit the adaptation.

2.15

Many, including the then Auditor-General, considered that the limited adaptation of IFRS to NZ IFRS did not produce accounting standards that were appropriate for public benefit entities. One of our concerns was that a large number of documents were issued for consultation in a relatively short period of about 12 months. We were also concerned that the standard-setter was reluctant to add guidance for public benefit entities.

2.16

Not surprisingly, with attention and resources focused on adopting and adapting IFRS, many important issues with public sector reporting did not receive the attention they needed. For example, little progress was made with a standard on reporting service performance information.

2.17

Nevertheless, an initial suite of NZ IFRS was completed in late 2004. This meant that there was a "stable platform" of accounting standards available for entities that chose to apply NZ IFRS for reporting periods beginning from 1 January 2005. The stable platform represented a significant milestone. Notwithstanding the overarching concerns expressed by the main stakeholders, the roll-out of the accounting standards generally reflected well on those involved in adapting IFRS to NZ IFRS.

Our concerns about the suitability of International Financial Reporting Standards for the public sector

2.18

We expressed two general concerns about adapting IFRS for the public sector. These were:

- the complexity of the requirements in NZ IFRS, particularly for smaller public entities, and;

- the difficulty associated with applying many of the requirements in NZ IFRS to public benefit entities.

2.19

IFRS were built on several fundamental principles that, mainly, do not apply to public benefit entities. Figure 4 sets out the fundamental principles of IFRS and includes comments on their suitability for public benefit entities.

Figure 4

Principles of International Financial Reporting Standards that were unsuitable for public benefit entities

| Underlying assumptions of IFRS | Suitability for public benefit entities |

|---|---|

| Entities have an over-riding profit-seeking objective. | Public benefit entities have an overall objective of providing goods and services for community or social benefit. |

| Transactions are invariably exchange in nature. | Many of the transactions of public benefit entities are non-exchange in nature. |

| Markets exist for these transactions to take place. | Markets often do not exist. Public benefit entities hold many specialised assets and have obligations that cannot be readily transferred to third parties. |

| Asset values are largely arrived at by referring to future cash flows. | An assessment of value needs to take account of the nature and purpose of the entity (that is, to deliver future services to the community) rather than future cash flows. |

| The main users of general purpose financial reports are investors, analysts, and regulators. | The main users of general purpose financial reports are Parliament and the public. |

Note: For the purposes of this report, we have not attempted to explain the complex difference between exchange and non-exchange transactions.

2.20

It was no surprise that accounting standards built on these principles were not well suited to public benefit entities.

Advocating for a new approach

2.21

We advocated for relevant and appropriate accounting standards for all public entities that would result in reporting that could be used for decision-making and to properly hold public entities to account.

2.22

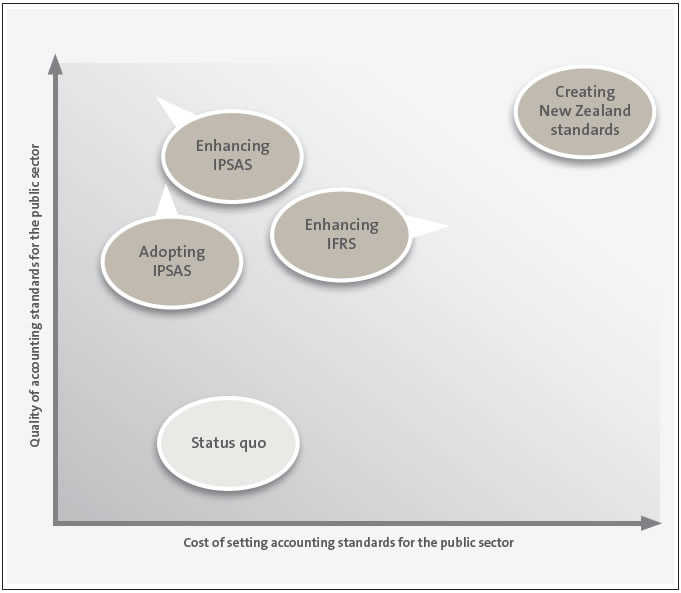

Our 2009 discussion paper outlined four broad approaches that could be used for future standard-setting. We explained the advantages and disadvantages of each approach. Figure 5 presents each of the four approaches based on the likely cost of setting accounting standards and the likely quality of the resulting standards.

Figure 5

Assessment of four approaches for setting accounting standards for the public sector

2.23

Enhancing IFRS would have involved making changes to IFRS to make the accounting standards suitable for public benefit entities in the public sector. This would have required significant changes to NZ IFRS and would have come at a high cost. We had concerns about the effectiveness of this approach, given that the Accounting Standards Review Board approved minimal changes to IFRS to create NZ IFRS.

2.24

Adopting IPSAS would have involved making minimal changes to IPSAS and adopting them for public benefit entities. This approach could have resulted in accounting standards suitable for public benefit entities because IPSAS are designed specifically for such entities. This approach could have cost less than the other approaches because few changes would have been needed.

2.25

Enhancing IPSAS would have involved making appropriate changes to IPSAS for public benefit entities in New Zealand. This approach could have resulted in high-quality, fit-for-purpose accounting standards for the public sector. However, it was recognised that this would cost more than directly adopting IPSAS.

2.26

Creating New Zealand standards would have left the standard-setter free to draw on principles, ideas, and requirements from various sources, including IPSAS and IFRS. This approach could have resulted in high-quality public sector accounting standards but would have taken much longer and cost much more.

2.27

We presented the four options and explained the need for change in the hope that our views would be considered in shaping the future standard-setting arrangements in New Zealand.

2: Controller and Auditor-General (June 2009), The Auditor-General's views on setting financial reporting standards for the public sector, Wellington.

3: The New Zealand Institute of Chartered Accountants amalgamated with its Australian equivalent in 2014. The new entity is known as Chartered Accountants Australia and New Zealand.

4: Our Office had a representative on the Financial Reporting Standards Board until 2008.