Part 4: Following up on our 2011 performance audit of Transpower New Zealand Limited

4.1

In September 2011, we published a report entitled Transpower New Zealand Limited: Managing risks to transmission assets. The report contained the findings and recommendations of a performance audit we had carried out.

4.2

Our 2011 performance audit asked how well Transpower was managing risk to the national electricity grid to reduce the chances of:

- power failure in the short term; and

- adopting an inadequate or excessive investment strategy for the medium to long term.

4.3

The grid is a national network of high voltage electricity assets. It comprises transmission lines, supporting towers and poles, substations and transformers, as well as associated assets. Transpower owns and operates the grid. It is responsible for ensuring that the grid is kept in good condition.

4.4

Transpower is also responsible for:

- transmitting electricity from where it is generated to cities and towns and some major industrial users;

- supplying lines companies that deliver electricity to homes and businesses; and

- managing New Zealand's power system so that electricity is delivered continuously when and where it is needed.

4.5

The first part of our question asked how well Transpower was managing risk to the grid to reduce the chances of power failure in the short term. We found that Transpower:

- was well placed to reduce the likelihood of power failure and to restore supply after a power failure;

- solved problems well and fixed many day-to-day problems with the grid when they occurred; and

- had put in place robust project, technical, and commercial governance to oversee complex projects. (These projects were part of the programme to significantly increase investment in grid capacity.)

4.6

The second part of our question focused on the risk of Transpower adopting an inadequate or excessive investment strategy for the medium to long term. We found that:

- Transpower lacked asset information available in a way to fully inform an investment strategy for the medium to long term;

- Transpower had accumulated much data about its assets, but the data had been recorded in different systems and formats;

- it was difficult to form an integrated view of risk throughout the fleet of assets,22 or of a group of assets at a particular site; and

- Transpower did not prioritise risk between asset management plans.

4.7

When we finalised our 2011 report, Transpower had recognised the need to improve how it managed risks to assets. Transpower had already prepared a unified long-term strategy, Transmission Tomorrow, describing main strategies to improve grid performance, system performance, and reliability and resilience. We considered that Transmission Tomorrow provided a sound basis to guide the grid's future development.

4.8

Our recommendations to Transpower were in two parts. First, we recommended that Transpower complete its programme for improving how it manages assets and risks by putting in place:

- an integrated system for managing assets;

- a comprehensive, quantitative, risk-based approach to managing assets; and

- long-term targets for what Transpower considers to be the appropriate level of risk at a network level.

4.9

Secondly, we recommended that the Board of Transpower actively monitor progress against Transmission Tomorrow and the prioritised work programme.

Following up our 2011 recommendations

4.10

In late 2013 and early 2014, we reviewed the initiatives Transpower has taken to address our 2011 recommendations. This involved discussions with the former Chief Executive and senior personnel in two of Transpower's divisions – grid development and grid performance.

4.11

Grid development is responsible for identifying the future needs of the grid's users, planning the national transmission grid, developing grid upgrade plans, managing the regulatory approval processes, and working with customers to develop their connection points. Grid performance is responsible for operating and maintaining grid assets such as substations and transmission lines.

4.12

We also examined extensive documentation about the initiatives Transpower has taken to improve asset and risk management.

What we found

4.13

In our view, Transpower has been proactive in its efforts to improve grid asset and risk management.

4.14

Transpower has set up a large number of initiatives covering all elements of asset and risk management. Many of the initiatives are still in the early stage of development. However, they are progressing on a measured path that, if continued, will meet best-practice asset management and deliver the long-term outcomes described in Transmission Tomorrow.

4.15

A particular strength is the asset management framework, including the comprehensive documentation that underpins it.

4.16

Transpower has used the asset and risk management initiatives to prioritise future investment proposals, even though it has acknowledged that some initiatives are "interim" measures.

Regulatory framework

4.17

Before setting out the detailed findings from our follow-up review, we briefly outline the regulatory framework governing Transpower.

4.18

The Commerce Commission regulates Transpower's transmission service revenue and performance targets under individual price-quality path regulation (as defined by Part 4 of the Commerce Act 1986).23

4.19

At present, Transpower is subject to the individual price-quality path determination covering four years to March 2015. This is known as Regulatory Control Period 1 (RCP1). The second Regulatory Control Period (RCP2) will apply for the five years from 2015 to 2020. Transpower is required to submit a proposal for capital and operational expenditure for RCP2 to the Commerce Commission.

4.20

Transpower submitted this proposal to the Commission in December 2013. The Commission is now considering and consulting on it. The Commission is expected to issue a determination setting out base capital and operational expenditure allowances and Transpower's service performance regime. The Commission will then use this information to set Transpower's forecast maximum allowable revenue for RCP2.

4.21

Transpower's proposal to the Commerce Commission is a substantial document. It mentions initiatives that Transpower has carried out in asset management and risk management. Our comments on Transpower's initiatives in this Part relate solely to our 2011 recommendations and not to the regulatory review process.

Initiatives to introduce an integrated system for managing assets

4.22

In 2011, we recommended that Transpower put in place an integrated system for managing assets. An integrated system would provide one consistent source of information about assets to enable good decision-making.

4.23

In our follow-up work, we had expectations about an integrated system for managing assets. We expected that:

- Transpower had developed a comprehensive asset management framework that clearly sets out asset management strategies, plans, and actions;

- the asset management planning included all elements seen as best practice – asset attribute data (such as description, location, value), asset condition and performance information, management strategies and operational strategies, as well as long-term financial forecasts;

- there had been solid progress in implementing a new asset management information system; and

- Transpower had obtained external certification of its asset management systems.

4.24

In our view, Transpower has made good progress in developing an integrated approach for managing assets.

Transpower's asset management framework

4.25

We expected Transpower to have prepared a comprehensive asset management framework. Transpower finalised this framework in November 2013. It consists of:

- an asset management policy;

- an asset management strategy that underpins the asset management policy and states the strategic objectives and approach to managing the grid assets;24

- "fleet" strategies;25

- asset management plans, which translate the fleet strategies into projects and budgets;26 and

- site strategies, which reconfigure the asset plans into work required for specific sites or substations.

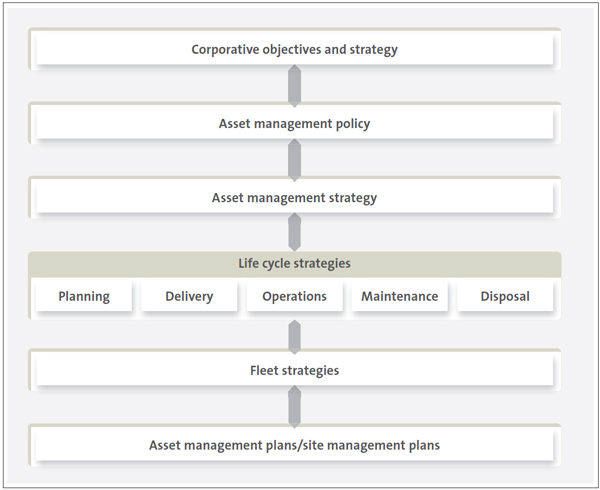

4.26

Figure 17 shows the suite of documents that make up Transpower's asset management framework. Each document serves a different purpose, but they complement each other effectively. The framework is consistent with the requirements of the new international standards on asset management.27

Figure 17

Transpower's asset management framework

Source: Transpower Asset Management Strategy, 2013.

4.27

The substantive content of the asset management strategies is contained in the fleet strategies. The fleet strategies include summaries of asset attribute data, asset condition and performance information, management strategies, and operational strategies. Importantly, they also outline issues to be addressed and aspects of asset management that require improvement. Some of the fleet strategies are large and detailed (for example, transformers). Others are briefer. Each fleet strategy's content is proportionate to the size and importance of that fleet.

4.28

By contrast, the asset management plans are essentially operational and capital expenditure budgets that extend to 2020.

4.29

Transpower's asset management policy was approved by the then Chief Executive, but not by the Board. In our view, the Board should specifically approve the policy, which is a short non-technical document (although it could be inferred that the policy has been indirectly approved through the RCP2 submission and other actions). However, a specific approval by the Board would give the policy additional power and status.

Transpower's asset management information system

4.30

We also expected that Transpower had made solid progress in setting up a new asset management information system (AMIS).

4.31

At a basic level, an AMIS will record the attribute data of the physical assets (such as description, location, value) and record the condition of assets. At a more advanced level, an AMIS can provide predictive information about maintenance and replacement intervals, workflow management, and performance information. It can also contribute to risk management.

4.32

In our 2011 report, we noted that Transpower's AMIS did not have the capabilities of a modern asset management system. Although extensive data was collected, it was stored in a relatively unstructured way, making it difficult to access. Transpower's AMIS also did not provide predictive capability.

4.33

In June 2013, Transpower implemented the first stage (release 1) of its Maximo asset management information system. The first stage involved capturing existing data from the previous systems. An independent review of the implementation process found that release 1 was well managed.

4.34

The next stage of the AMIS development (release 2) began in July 2013. It is expected to be completed by June 2014. This stage will incorporate functionality to improve workflow management, inventory management, health and safety management, and enhanced reporting capability.

4.35

The first stage of the AMIS development has progressed smoothly and to established timelines. The more crucial measure of success of the project will be the outcome of release 2, because this begins to bring in the more advanced functionality of an asset management information system. In our view, progress on release 2 is on track.

Certification of Transpower's asset management systems and practice

4.36

In our 2011 report, we noted that Transpower intended to adopt the requirements of PAS 55 as its guide to good asset management practice. PAS 55 stands for Publicly Available Specification 55. It is a United Kingdom "quasi-standard" for asset management practices. It has been widely applied in the United Kingdom and Europe, especially in the energy and utility sectors.

4.37

In April 2012 and November 2013, Transpower contracted an external assessor to do a "gap analysis" of Transpower's asset management practices, to see how they compared with the requirements of PAS 55. The November 2013 assessment noted a considerable improvement in compliance with the provisions of PAS 55 from the April 2012 assessment. The November 2013 assessment showed "79% compliance" with the provisions of PAS 55. The assessment also found that Transpower had made excellent progress in core asset management documentation.

4.38

Transpower had planned to complete certification to the requirements of PAS 55 by June 2014. A review by a PAS 55 accreditation agency is under way.

Other ways Transpower is working to improve how it manages assets

4.39

Transpower has been working on other processes and documentation relevant to asset management. For example:

- Transpower has been building a database of routine maintenance activities carried out during the last 10 years. This is known as the maintenance activity and cost model. An associated project was "data mining" historical maintenance transactions. This was done to identify potential cost savings.

- Transpower has developed a cost estimation tool known as TEES. This is a price book for individual project elements and unit rates for labour and materials.

- Transpower has prepared standard maintenance procedures (SMPs). These are documented mandatory procedures for all fieldwork maintenance. SMPs provide two main benefits: a standard approach to tasks and a consistent platform for service pricing. To date, 450 SMPs have been prepared.

- Transpower has introduced specific categories of maintenance – preventive, corrective, predictive, and proactive. When the categories become embedded into the overall maintenance system, asset interventions will be informed by risk and asset health, rather than being reactive or time based.

4.40

Transpower documents record that several aspects in the development of Transpower's asset management approach were regarded as "out of scope". These included hardware for running systems that support asset management functions, the network communication system, customer-owned assets at Transpower sites, and generic corporate disaster-recovery processes.

4.41

Industry best practice on asset management, as contained in ISO 55000 and guidance from the New Zealand National Asset Management Support Group, strongly emphasises that asset management is a broad and multi-disciplinary approach. It should embrace all relevant systems and organisational efforts. Relevant systems could also embrace those areas that might seem peripheral to core asset management but that do affect asset management. We consider that Transpower will need to ensure that "out of scope" activities do not slow or hamper the asset management projects now under way.

A comprehensive, quantitative, risk-based approach to managing assets

4.42

The second recommendation we made in 2011 was that Transpower should implement a comprehensive, quantitative, risk-based approach to managing assets. This approach should allow for risk to be traded off against the cost of mitigating the risk. We saw this as essential for prioritising investment in the grid.

4.43

In our follow-up work, we expected that a comprehensive, quantitative, risk-based approach to managing assets would include:

- a concise, clear policy on asset risk management;

- the melding of "bottom-up" asset-based risk initiatives with "top-down" or corporate-oriented risk management;

- measured progress in developing sophisticated, quantitative risk tools;

- the use of risk in prioritising investments; and

- appropriate reporting of risk at various management levels.

4.44

We were impressed by the progress Transpower has made in developing a comprehensive, quantitative, risk-based approach to managing assets.

Transpower's asset risk management policy

4.45

Transpower has prepared an asset risk management policy. This became effective in December 2013. The policy sets the minimum standard of asset risk management applying to grid business and operations. The policy is part of, but subordinate to, an overarching Transpower risk management policy. The asset risk policy outlines risk management principles, scope, governance and responsibilities, and risk categories.

4.46

The following associated documents underpin the asset risk management policy:

- asset risk management process – this describes how the policy should be implemented;28

- asset health indices – this relates to the remaining life of an asset (see paragraphs 4.50-4.51); and

- criticality framework – this relates to assets having different degrees of importance and different vulnerabilities (see paragraphs 4.52-4.53).

How Transpower melds "bottom-up" and "top-down" risk activities

4.47

In terms of melding "bottom-up" with "top-down" risk activities, the risk policy notes a "lines of defence" concept based on three "lines". The first line of defence is the specific asset-risk activities in grid management. The second line of defence consists of activities done as part of Transpower's internal governance. The third line of defence is Transpower's internal and external audit function.

4.48

Transpower has also begun a series of asset-risk workshops to communicate the risk approach. The workshops also aim to gain a greater understanding of risks and potential treatments. It is expected that this will result in a collated revised risk register by mid-2014.

Tools Transpower uses to quantify risks

4.49

As part of its risk-based approach to managing assets, Transpower uses a combination matrix of "asset health indices" and "asset criticality". These approaches are essential building blocks of a comprehensive asset risk management framework that will ultimately include fully quantified risk assessment for the higher criticality and high value asset portfolios.

4.50

Asset health indices are an indicator of the estimated remaining life of assets. Remaining life is defined as the estimated time before an intervention might be required in response to increasing asset risk. To date, asset health indices have been developed for three core assets – transmission lines, transformers, and circuit breakers. Indices for other fleet assets will be progressively developed.

4.51

Remaining life is based on a number of factors, such as asset condition, degradation projections, failure and outage rates, as well as the actual age of the asset and the life expectancy for the asset class. The remaining life is categorised into five periods: "now due", 0-2 years, 2-7 years, 7-12 years, and beyond 12 years.

4.52

The asset criticality framework recognises that, in terms of the grid, assets have different importance or represent different vulnerabilities. Transpower has assigned criticality at each "point of service". These are based on the effect of a loss of supply at each specific "point of service". Point of service criticality reflects the type and scale of load or generation connected to the grid at a point of service. Point of service criticality also reflects the economic effects that interruptions cause. It is assigned into three categories – "high priority", "important" and "standard". For example, "high priority" would include a load of national significance.

4.53

Transpower has also defined bus and circuit criticality as an indicator of the effect that an outage of a network component (for example, transmission or transformer circuit) has on a point of service. Transpower intends adding a third element to its framework – individual asset criticality. Asset criticality reflects the effects of individual outages on points of service, such as a circuit breaker or transformer. In addition to the effect on customers, the framework will also be further developed to embrace safety, environment, and financial impacts.

How Transpower uses risks in prioritising investments

4.54

During our follow-up work, we saw that Transpower has applied the risk framework (asset health indices and asset criticality) in fleet asset management strategies and forward financial projections. In our view, this enables Transpower to arrive at prioritised investment proposals in the period covered by the asset management plans.

How Transpower reports risks

4.55

One of our expectations in the follow-up review was that risks are being reported to appropriate management levels. We found that there are multiple layers of risk reporting, which culminate in the "top ten" risks being reported to the Board each month. A corporate governance external review was done in June 2013. This included a section on how risks are reported to the Board. The report on the review noted a misalignment between how network risks and non-network risks are reported. This appears to have been addressed in the subsequent asset risk policy.

Remaining work for Transpower to complete a fully developed approach to asset risk

4.56

Transpower has made good progress towards a fully developed approach to asset risk. It knows what it still has to do. It has planned initiatives to arrive at an integrated risk regime, including the use of fully quantified risk assessment techniques. We encourage Transpower to complete this work by:

- fully developing its asset risk register (which is due shortly);

- extending asset health indices to the remaining asset fleets;

- developing safety, environment, and financial dimensions to the asset criticality framework; and

- developing the criticality framework to include the effect of individual asset outages on customers.

Long-term targets on the appropriate level of risk at a network level

4.57

The third of our 2011 recommendations was that Transpower put in place long-term targets for what is considered to be the appropriate level of risk at a network level, as well as the associated network performance and quality measures.

4.58

In our follow-up review, we expected that:

- the long lives of many of Transpower's assets (beyond 40 years in some instances) would be reflected in how risks are identified and assessed;

- asset and network risk management would be increasingly focused on the performance of assets to meet agreed standards or levels of service; and

- network quality and performance would be comparable to international peer organisations.

4.59

In our view, Transpower is appropriately addressing long-term risks to the grid's performance.

How Transpower identifies and manages long-term risks to the grid's performance

4.60

In early 2011, Transpower published Transmission Tomorrow. This describes three main strategies to improve how the grid performs, improve systems performance, and improve reliability and resilience. Transmission Tomorrow included committed initiatives to be completed within five years, potential outcomes within 10 and 20 years, and possible outcomes beyond 20 years.

4.61

A December 2013 update report to Transpower's Network Risk Committee noted initiatives and progress towards meeting Transmission Tomorrow strategies. These included initiatives in matters such as future grid planning, reliability risks, and operating risks. Examples of initiatives about reliability risks included:

- a transformer replacement programme (now under way);

- procurement of a mobile substation so that maintenance can be carried out at smaller substations without turning off the power to communities; and

- "high impact – low probability" risk reviews completed at four major substations (these detail risks that have a small probability of occurring but that would be significant if an event does occur).

4.62

The risk initiatives we noted on asset health and asset criticality (see paragraphs 4.49-4.53) are expected to increasingly bear fruit in the longer term, when they extend to environmental, safety, and financial dimensions.

4.63

Transpower has included several grid and asset performance measures in its submission to the Commerce Commission on the RCP2 for the years 2015-20. There are targets for each measure, and Transpower has proposed an incentive regime that would reward or penalise Transpower depending on its performance against the measures and targets.

4.64

In its RCP2 submission, Transpower included long-term performance targets beyond 2020. This reflects the view that a five-year period is a short time compared with the expected lives of most assets. Although changes in operation and maintenance strategies might result in short-term to medium-term performance improvements, longer-term performance improvements will come from improved asset performance (fewer outages and interruptions, and condition-based asset management).

4.65

Transmission Tomorrow outlined "committed initiatives" in the next five years (from 2011). A review of those initiatives by Transpower's Network Risk Committee in December 2013 indicates that Transpower is carrying out these initiatives in a methodical manner.

How network performance compares internationally

4.66

Transpower participates in an international comparison of performance that covers the operation and maintenance of transmission assets. This is called ITOMS.29 A comparison is done every two years. In our 2011 report, we stated that Transpower's benchmarking results had shown worsening performance since 2003. The 2011 ITOMS study showed that Transpower's composite service level had improved significantly. Transpower's composite service level was around the average of 27 international transmission utilities. However, its composite cost level was still above average.

4.67

The results from the 2013 ITOMS study had not been published when we carried out our follow-up work. Transmission Tomorrow notes that a potential outcome of the risk and asset management initiatives is "asset performance comparable to that of our international peers". This potential outcome is timetabled "within 10 years".

Monitoring by the Board of Transpower

4.68

In our 2011 report, we recommended that the Board of Transpower actively monitor progress against Transmission Tomorrow and the prioritised work programme on risk and asset management.

4.69

In our view, from 2013 Board papers we have seen, the Board has actively monitored the progress against Transmission Tomorrow.

Our concluding comments on how Transpower manages risks to assets

4.70

In our view, Transpower has been proactive in its efforts to improve grid asset and risk management since we published our 2011 report.

4.71

Transpower has set up a large number of initiatives that cover all elements of asset and risk management. Many of the initiatives are still in various stages of development. They are progressing on a measured path that, if continued, will meet best-practice asset management and deliver the long-term outcomes described in Transmission Tomorrow.

4.72

A particular strength is the asset management framework, including the comprehensive documentation that underpins it.

4.73

The asset and risk management initiatives have been used to prioritise future investment proposals, even though some have been acknowledged as "interim" measures.

4.74

As part of our follow-up review, we discussed the following matters with Transpower:

- The Board of Transpower should formally approve the asset management policy.

- Transpower should ensure that all asset management initiatives are progressed on a "broad front", leaving no areas lagging behind. Because of the interrelationships and interconnectedness between the initiatives, any weak link will imperil the strength of the "asset management chain".

- Transpower should continually monitor asset and risk management activities that are currently regarded as "out of scope" to ensure that there is no impediment to, or slowing of, asset and risk-management initiatives.

- The content of asset management plans, which are presently short-term budgets, should be extended beyond 2020 as and when further reliable information becomes available.

4.75

Through our annual audit process, we will continue to maintain an interest in Transpower's progress with these matters.

22: In Transpower, "fleet" means a distinct group of assets, rather than vehicle or plant fleets.

23: Price-quality regulation is designed to mimic the effects seen in competitive markets so that consumers benefit in the long term. This includes making sure that businesses have incentives to innovate and invest in their infrastructure, and to deliver services efficiently and reliably at a quality that consumers expect. For a set of businesses (including Transpower) that are not consumer owned, the Commerce Commission sets what are known as "price-quality paths". The paths either restrict the amount of revenue a regulated business can earn or set the maximum average prices it can charge. The paths also specify the service quality standard each business must meet.

24: The strategy includes five "lifecycle" strategies – planning, delivery, operations, maintenance, and disposal.

25: There are 25 grid asset fleets grouped into 14 fleet strategy documents.

26: The current asset management plans cover the period to June 2020.

27: ISO 55000 Asset management – Overview, principles and terminology; ISO 55001 Asset management – Management systems – requirements; ISO 55002 Asset management – Management systems – Guidelines for the application of ISO 55001. Published by the International Organization for Standardization, January 2014.

28: This document was in "pending" status at January 2014.

29: International Transmission Operations and Maintenance Study.