Part 4: Non-standard audit reports issued in 2009

4.1

In this Part, we report on the non-standard audit reports issued during the 2009 calendar year on the financial statements of public entities within our central government portfolio of audits.1

4.2

The financial statements of school boards of trustees are part of our central government portfolio of audits.2 In the following text, we discuss schools separately from the other public entities.

Why are we reporting this information?

4.3

An audit report is addressed to the readers of an entity's financial statements. However, all public entities are ultimately accountable to Parliament for their use of public money and their use of any statutory powers or other authority given to them by Parliament. Therefore, we consider it important to draw Parliament's attention to the matters that give rise to non-standard audit reports.

4.4

In each case, the issues underlying a non-standard audit report are drawn to the attention of the entity and discussed with its governing body, or chief executive in the case of a government department.

What is a non-standard audit report?

4.5

A non-standard audit report3 is one that contains:

- a qualified opinion; and/or

- an explanatory paragraph.

4.6

An auditor expresses a qualified opinion because of:

- a disagreement between the auditor and the entity about the treatment or disclosure of a matter in the financial statements; or

- a limitation in scope because the auditor has been unable to obtain enough evidence to support, and accordingly is unable to express, an opinion on the financial statements or a part of the financial statements.

4.7

There are three types of qualified opinion:

- an "adverse" opinion (see paragraphs 4.11-4.12);

- a "disclaimer of opinion" (see paragraph 4.16); and

- an "except-for" opinion (see paragraph 4.19).

4.8

The auditor will include an explanatory paragraph (see paragraph 4.24) in the audit report to emphasise a matter such as:

- a breach of law;

- a fundamental uncertainty; or

- a significant judgement affecting the financial statements.

4.9

Auditors have to include an explanatory paragraph in the audit report in such a way that it cannot be mistaken for a qualified opinion.

4.10

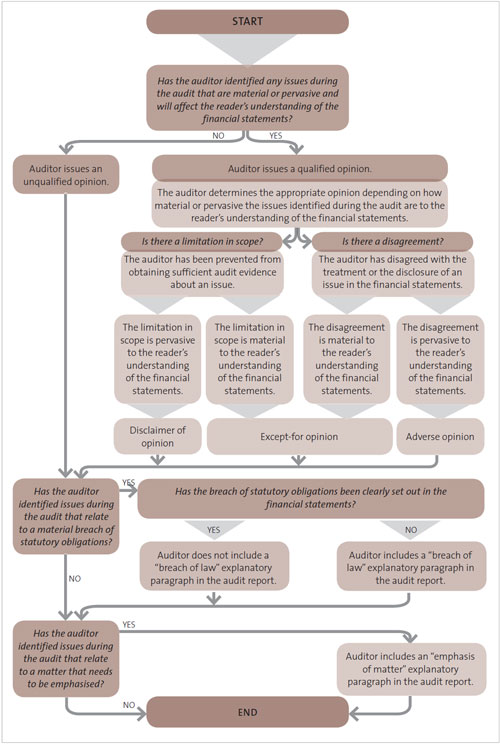

Figure 18 outlines the decisions that an auditor has to make when considering the appropriate form of the audit report.

Figure 18:

Deciding on the appropriate form of the audit report

Adverse opinions

4.11

An adverse opinion is the most serious type of non-standard audit report.

4.12

An adverse opinion is expressed when the auditor and the entity disagree about the treatment or disclosure of a matter in the financial statements and, in the auditor's judgement, the treatment or disclosure is so material or pervasive that the financial statements are seriously misleading.

4.13

During 2009, the auditor expressed an adverse opinion for two public entities:

- Royal New Zealand Navy Museum Trust Incorporated; and

- RNZAF Museum Trust Board.

4.14

The Appendix sets out the details of the adverse opinions.

4.15

We are pleased to report that it was not necessary for auditors to express an adverse opinion on any school boards' financial statements in the 2009 calendar year.

Disclaimers of opinion

4.16

A disclaimer of opinion is expressed when the scope of an auditor's examination is limited, and the possible effect of that limitation is so material or pervasive that the auditor has not been able to obtain enough evidence to support an opinion on the financial statements. The auditor is accordingly unable to express an opinion on the financial statements as a whole or on part of them.

4.17

During 2009, a disclaimer of opinion was expressed for one school – Te Kura Kaupapa Māori o Ruamata. The Appendix sets out the details of the disclaimer of opinion.

4.18

We are pleased to report that it was not necessary for auditors to express a disclaimer of opinion on any non-school public entity's financial statements in the central government portfolio in 2009.

Except-for opinions

4.19

An except-for opinion is expressed when the auditor reaches one or both of the following conclusions:

- The possible effect of a limitation in the scope of the auditor's examination is (or may be) material but is not significant enough to require a disclaimer of opinion. The opinion is qualified by using the words "except for the effects of any adjustments that might have been found necessary" had the limitation not affected the evidence available to the auditor.

- The effect of the treatment or disclosure of a matter with which the auditor disagrees is (or may be) material, but is not, in the auditor's judgement, significant enough to require an adverse opinion. The opinion is qualified by using the words "except for the effects of" the matter giving rise to the disagreement.

4.20

An except-for opinion can be expressed when the auditor concludes that a breach of statutory obligations has occurred and that the breach is material to the reader's understanding of the financial statements. An example of this is where a Crown entity has breached the requirements of the Crown Entities Act 2004 because it has not included budgeted figures in its financial statements.

4.21

During 2009, auditors expressed except-for opinions for 14 non-school public entities (2008: 12 non-school public entities):

- Auckland DHB Charitable Trust (a trust controlled by Auckland District Health Board);

- Christchurch Polytechnic Institute of Technology and Group;

- Counties Manukau District Health Board and Group;

- Ivey Hall and Memorial Hall 125th Anniversary Appeal Gifting Trust (a trust controlled by Lincoln University);

- Ivey Hall and Memorial Hall 125th Anniversary Appeal Taxable Activity Trust (a trust controlled by Lincoln University);

- Massey University and Group;

- Massey Ventures Limited and Group (a subsidiary of Massey University);

- New Zealand Historic Places Trust;

- Ngati Whakaue Educational Endowment Trust Board;

- Orcon Internet Limited (a subsidiary of Kordia Limited);

- Tauranga Moana Maori Trust Board;

- Tūwharetoa Māori Trust Board;

- UCOL International Limited (a subsidiary of Universal College of Learning, or UCOL); and

- Wellington Institute of Technology.

4.22

Auditors expressed except-for opinions for the financial statements of 30 schools (2008: 29 schools):

- Allenvale Special School & Res. Centre;

- Excellere College;4

- Hillcrest School (Pahiatua);

- Kiwitahi School;

- Mayfield Primary School;

- New Plymouth Girls' High School;

- Paeroa Central School;

- Piopio Primary School;

- Rawhitiroa School;

- Ross Intermediate (2 years);

- Saint Peter's College (Palmerston North);

- Saint Joseph's School (Hastings);

- Sunset Primary School;

- Taumarunui High School Community Trust;

- Te Whanau-a-Apanui Area School;

- Te Kura Kaupapa Māori o Manurewa;

- Te Kura Kaupapa Māori o Ngati Kahungunu ki Heretaunga;

- Te Kura Kaupapa Māori o Tamarongo;

- Te Kura Kaupapa Māori o Waiuku;

- Te Kura-a-iwi o Whakatupuranga Rua Mano;

- Te Wharekura o Rakaumangamanga;

- Titahi Bay Intermediate;

- Tokoroa East School;

- Upper Hutt School;

- Wanganui City College;

- Wellington East Girls' College;

- Wellington Girls' College;

- Whanganui Awa School; and

- Whareorino School.

4.23

The Appendix sets out the details of the except-for opinions. In some cases, the audit opinion was qualified for more than one reason.

Explanatory paragraphs

4.24

In certain circumstances, it may be appropriate for the auditor to include additional comments in the audit report. Through an explanatory paragraph, the auditor emphasises a matter that they consider relevant to a reader's proper understanding of an entity's financial statements.

4.25

For example, an explanatory paragraph could draw attention to an entity having breached its statutory obligations for matters that may affect or influence a reader's understanding of the entity's financial statements. In this situation, the audit report would normally draw attention to the breach only if the entity had not clearly disclosed the breach in its financial statements.

4.26

During 2009, there were 10 main types of matters emphasised by auditors of non-school public entities in explanatory paragraphs.

4.27

The first type of matter is funding for a capital appropriation that was not recognised as an equity transaction. The audit opinion for the University of Auckland included such an explanatory paragraph.

4.28

The second type of matter is the existence of high degree of uncertainty about the value of unlisted mortgage-backed securities that could have a material effect on the statement of financial performance and the statement of financial position. The audit opinion for the Public Trust included such an explanatory paragraph.

4.29

The third type of matter is the reduction made by a Board to the valuation of buildings carried out by an independent valuer that was not material to the financial statements as a whole. The audit opinion for MidCentral District Health Board included such an explanatory paragraph.

4.30

The fourth type of matter is fundamental uncertainty about the validity of the "going concern" assumption. Entities whose audit reports included such an explanatory paragraph were:

- New Zealand Institute for Plant and Food Research Limited and Group; and

- GraceLinc Limited (a subsidiary of New Zealand Institute for Plant and Food Research Limited).

4.31

The fifth type of matter is serious financial difficulties faced by the entity. The audit opinion for Whanganui District Health Board included such an explanatory paragraph.

4.32

The sixth type of matter is the current financial statements being issued to replace previously issued financial statements for clarification on funding issues. The audit opinion for Manukau Institute of Technology included such an explanatory paragraph.

4.33

The seventh type of matter is financial statements appropriately prepared on the "going concern" assumption because the financial statements contained appropriate disclosures about the use of the going concern assumption. Entities whose audit reports included such an explanatory paragraph were:

- AgResearch (PPGR Consortia) Limited (a subsidiary of AgResearch Limited);

- AgResearch (Pastoral Genomics Consortia) Limited (a subsidiary of AgResearch Limited);

- Air New Zealand Consulting Limited (a subsidiary of Air New Zealand Limited);

- Air New Zealand Associated Companies (Australia) Limited (a subsidiary of Air New Zealand Limited);

- Cardiff Holdings No.1 Limited (a subsidiary of Genesis Power Limited);

- Cardiff Holdings No.2 Limited (a subsidiary of Genesis Power Limited);

- CelcomOne Limited (a subsidiary of AgResearch Limited);

- Celcom Three Limited (a subsidiary of AgResearch Limited);

- ContainerScan Limited (a subsidiary of AgResearch Limited);

- Eagle Air Maintenance Limited (a subsidiary of Air New Zealand Limited);

- GP No.1 Limited (a subsidiary of Genesis Power Limited);

- GP No.2 Limited (a subsidiary of Genesis Power Limited);

- GP No.4 Limited (a subsidiary of Genesis Power Limited);

- GP No.5 Limited (a subsidiary of Genesis Power Limited); and

- Kupe Holdings Limited (a subsidiary of Genesis Power Limited).

4.34

The eighth type of matter is where the "going concern" assumption was appropriately not used because organisations were disestablished. Entities whose audit reports included such an explanatory paragraph were:

- E-Learnz Incorporated (a subsidiary of Eastern Institute of Technology Limited);

- iPredict Limited (a subsidiary of Victoria University of Wellington);

- Land Transport New Zealand;

- Marlborough Provincial Patriotic Council;

- Ngāi Tahu Ancillary Claims Trust;

- New Zealand Fast Forward Limited (a subsidiary of New Zealand Fast Forward Fund Limited);

- Predictions Clearing Limited (a subsidiary of Victoria University of Wellington); and

- Southland Provincial Patriotic Council.

4.35

The ninth type of matter is where the budget figures were from an updated budget that was approved by the Board but did not comply with the Crown Entities Act 2004. Entities whose audit reports included such an explanatory paragraph were:

- Southland District Health Board; and

- Otago District Health Board.

4.36

The tenth type of matter is where breaches of statutory obligations were disclosed in the audit reports. Entities whose audit reports included such breaches were:

- AgResearch (Meat Biologics Consortia) Limited (a subsidiary of AgResearch Limited);

- AgResearch Plant Bio Holding Limited (a subsidiary of AgResearch Limited);

- AgResearch Shelf Four Limited (a subsidiary of AgResearch Limited);

- AgResearch Strategic Investments Limited (a subsidiary of AgResearch Limited);

- AgResearch (USA) Limited (a subsidiary of AgResearch Limited);

- Celentis Limited (a subsidiary of AgResearch Limited);

- Grasslanz Technology Limited (a subsidiary of AgResearch Limited);

- Ministry of Pacific Island Affairs;

- Paraco Technology Limited (a subsidiary of AgResearch Limited); and

- Phytagro New Zealand Limited (a subsidiary of AgResearch Limited).

Schools

4.37

Because of the number of non-standard audit reports in each category, we are not listing each school for which the auditor included an explanatory paragraph in the audit report. We are instead reporting the types of explanatory paragraphs that were issued and the number of schools that received each type.

4.38

There were two main types of matters emphasised by auditors in explanatory paragraphs:

- school closures (five schools, 18 transport networks, and two subsidiaries); and

- serious financial difficulties (17 schools and one subsidiary).

4.39

There were six major types of explanatory paragraphs included by auditors for breaches of law:

- not reporting by 31 May 2009 (63 schools);

- borrowing above the permitted limit without approval (14 schools);

- not submitting financial statements for audit by 31 March 2009 (11 schools);

- investing in non-approved institutions (nine schools);

- not including the required variation statements (six schools); and

- not having a 10-year property plan (five schools).

4.40

Most schools disclose breaches of law in their financial statements. Therefore, the above figures should not be taken as a picture of compliance generally.

4.41

In addition, auditors emphasised matters for other reasons for 21 schools and one subsidiary.

4.42

The Appendix contains more information about the explanatory paragraphs that were included in audit reports.

1: We report separately on entities within the local government portfolio, in our yearly report on the results of audits for that sector.

2: There are about 2450 state schools governed by boards of trustees, which are made up of members of the local community (usually parents of children attending the school). The board of each school is a Crown entity and, as such, is obliged to prepare annual financial statements in accordance with generally accepted accounting practice.

3: A non-standard audit report is issued in accordance with the New Zealand Institute of Chartered Accountants' Auditing Standard No. 702: The Audit Report on an Attest Audit.

4: Two except-for opinions were expressed for the College covering different periods. The first covered the period before the College ceased to be a state school, and the second covered the period after the College became a state school again.

page top