Part 2: Rates postponement policies

2.1

In this Part, we:

- describe optional rates postponement policies;

- describe postponement policies on the grounds of hardship;

- note the effect of territorial authorities acting as collecting agents for regional councils; and

- describe the effect of rates postponement on ratepayers’ equity.

2.2

Appendix 3 lists issues that councils adopting a rates postponement policy may wish to consider when designing the policy.

Description of optional rates postponement policies

2.3

The four councils offering optional rates postponement that we audited have

between 2 and 29 ratepayers currently postponing rates. These councils were

unsure whether they would receive a substantial number of applications for rates

postponement in the future. Several councils commented that their optional rates

postponement policies were not yet well known or understood by ratepayers. They

also considered that the current generation of retired people had an aversion to

getting into debt, which might discourage them from participating in the scheme. Several councils commented that the number of applications might increase as

the “baby boomer” generation move into retirement. All councils involved in the

optional rates postponement scheme told us that they saw it as a valuable way

of offering ratepayers another choice about how to pay their rates. They also said

they saw it as a “long-term” policy that required an upfront investment, but that

would not necessarily have a large number of participants until some time in the

future.

Eligibility criteria

2.4

Optional rates postponement is generally open to ratepayers who are over 65. For these ratepayers, postponement is indefinite and payment is required on the

death of the ratepayer or sale of the property. Ratepayers who are younger than 65

can also apply, but will have a set term of postponement of up to 15 years.

Equity

2.5

All applications are run through an actuarial model. The model estimates how

much the ratepayer will owe in postponed rates (including interest and fees) at

the end of their statistically determined lifeexpectancy, as well as the likely value

of their property at that time. Rates postponement is granted only if the model

suggests that the postponed rates will not accumulate to more than 80% of the

ratepayer’s equity in the property.

2.6

If the model predicts that the postponed rates will exceed 80% of the equity in the property, the ratepayer may be able to postpone only a portion of their rates.

2.7

Because rates have priority over mortgage debt, any mortgages against the

property are not taken into account when assessing the equity available for

rates postponement. However, ratepayers who have an outstanding mortgage

against their property need to seek the consent of their mortgagee before rates

postponement will be granted.

2.8

If, when the property is sold, the price realised is less than the amount of

postponed rates owed to the council, the council will not seek to recover the

difference from the ratepayer or their estate. This “no negative equity” clause

guarantees that a ratepayer or their estate will never have to pay the council more

than the value of their property when it is sold. Councils charge an annual reserve

fund fee to cover the potential for loss on any such properties, and this fee is

added to the postponed rates.

Decision facilitation

2.9

All ratepayers who wish to postpone their rates are required to attend at least one

decision facilitation session with a decision facilitator from Relationship Services. Relationship Services is contracted by R P Scheme Managers to provide this service

in all the areas where councils offer optional rates postponement.

2.10

The decision facilitator must certify that the ratepayer understands the

implications of postponing their rates before the council will grant postponement.

Security

2.11

Rates assessed, including postponed rates, are a statutory charge against

the property they are levied on.1 When postponing rates, councils register a

notification of charge on the title of the property concerned. This notification of

charge acts as an alert to anyone searching the title that rates may have been

postponed. The notification of charge on the title also prevents the property being

sold without the council being notified.

2.12

It is a requirement of optional rates postponement that ratepayers insure their

houses, to further protect the council’s interest.

Fees and interest

2.13

Fees and interest vary with each consortium council’s individual postponement

policy.

2.14

Most councils charge a once-only application fee of $50. All councils charge a

once-only decision facilitation fee of $300.

2.15

All councils charge an annual management fee of 1% on the outstanding balance. All councils also charge an annual 0.25% reserve fund fee on the outstanding

balance. This goes into a “reserve fund”, which each council manages individually. The purpose of this fund is to cover the council’s costs if the amount of rates

postponed on a given property exceeds the value of that property when it is sold. Some councils also charge an annual administration fee of between $50 and

$100.

2.16

All consortium councils charge interest on the balance of postponed rates, usually

at the council’s rate of borrowing (that is, the interest that the council pays to

service its own debt).

2.17

The interest and all fees, including the once-only fees, are usually added to the

postponed rates. However, the ratepayer can, if they choose, pay any amount of

the outstanding balance of their postponed rates (including fees and interest) at

any time without incurring a penalty.

Cost to other ratepayers

2.18

All consortium councils state in their policy objective that the full cost of rates

postponement should be met by the ratepayers who are postponing their rates. Accordingly, no part of the cost of rates postponement schemes is borne by other

ratepayers.

Description of hardship rates postponement policies

2.19

Fifty-five local authorities (out of a total of 85) offer rates postponement on

grounds of financial hardship. This number includes nine of the 14 councils that

currently offer optional rates postponement.

2.20

We visited or spoke to staff of eight councils that offer rates postponement on

hardship grounds only. These councils have between none and 10 ratepayers

currently postponing their rates. One council commented that they had received

only one application for rates postponement in 25 years. None of the councils

anticipated an increase in the number of applications for rates postponement on

the grounds of hardship. Several councils noted that the recent changes to the

central government rates rebate scheme would help low-income ratepayers who

might otherwise apply for rates postponement.2

Eligibility criteria

2.21

All councils that offer rates postponement on the grounds of hardship require

applicants to disclose their income and assets. Some councils have a set formula

for deciding whether ratepayers are eligible to have all or some of their rates

postponed, based on their income and assets. At other councils, staff assess

applicants to decide whether they are suffering financial hardship. At the two

councils we audited that offer rates postponement on hardship grounds only, the

rates postponement files showed that the applicants were in extreme financial

hardship, with low incomes, and with very few assets other than their properties.

2.22

Other eligibility criteria in some councils’ policies include:

- that ratepayers have substantial equity in their properties;

- that ratepayers are aged over 60 or 65;

- that ratepayers provide evidence of having sought budgeting advice; and

- that ratepayers have lived in the district or their house for a minimum length of time.

Term of postponement

2.23

Some councils require that ratepayers apply separately for the postponement

of each year’s rates. Other councils require only one application, and then

automatically postpone the ratepayer’s rates until either the ratepayer’s property

is sold or the ratepayer requests postponement to cease.

Which rates are eligible to be postponed

2.24

Council policies fall into one of three options:

- ratepayers are able to postpone all current and future rates; or

- ratepayers are able to postpone a portion of current and future rates, but are still required to make a minimum annual payment (usually $520 a year – that is, $10 a week); or

- ratepayers are able to postpone arrears, but are required to make arrangements for the payment of future rates.

Security

2.25

All councils that offer rates postponement on hardship grounds have a policy

of registering a notification of charge on the title of the ratepayer’s property to

indicate that rates may have been postponed and to ensure that the property is

not sold without the council being notified.

2.26

Some councils require that the ratepayer insure their house.

Interest and fees

2.27

Rates postponement policies generally state that councils will charge interest on

postponed rates, calculated at the council’s rate of borrowing.

2.28

Councils vary as to whether they charge an initial application fee and/or an annual

administration fee or no fees.

Territorial authorities acting as collecting agents for regional councils

2.29

Some regional councils collect their own rates, while others have their rates

collected for them by the relevant district or city council. Several regional

councils whose rates are collected by territorial authorities match their rates

postponement policies with the policies of their collecting agent(s). In our view,

this is good practice.

The effect of rates postponement on ratepayers’ equity

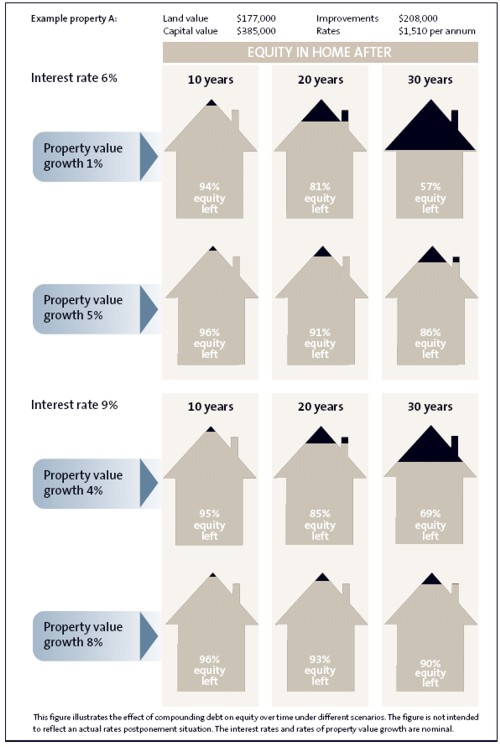

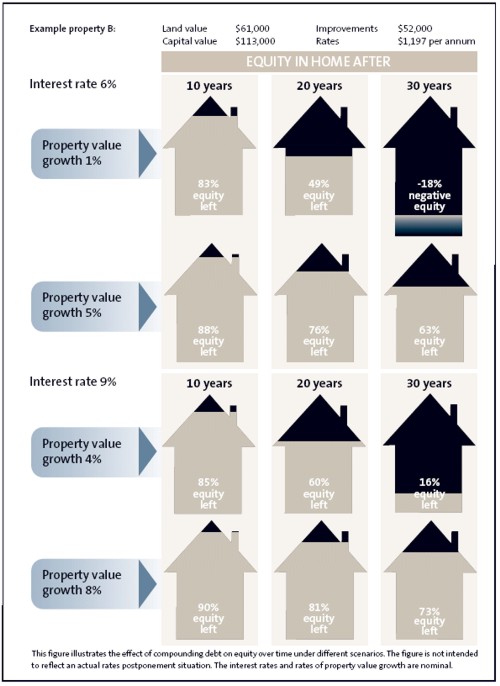

2.30

Figures 1 and 2 illustrate the effect of rates postponement on two sample

properties using different interest rates (6% and 9%)3 and different rates of

property value growth (1% and 5%, and 4% and 8%). The figures illustrate the

effect on the equity in the sample properties after 10, 20, and 30 years. We have

chosen scenarios that reflect a wide range of situations to show the effect of

compounding debt on equity, rather than choosing scenarios that reflect actual

rates postponement situations.

2.31

The figures were produced using a model created by our actuary. The model uses

the Department of Statistics New Zealand lifetables 2000-02. The full data sets

these diagrams were generated from are shown in Appendix 5.

2.32

As can be seen from the figures, differences in interest rates and rates of property

value growth create significant differences in the outcome, particularly over the

longer term.

2.33

Relatively low rates of increase in property values along with higher interest rates

could lead to a situation where the value of the postponed rates exceeds the final

sale value of the property (the example in Figure 2 with shading under the house). If that happened, the council would not be able to recover the full value of the

postponed rates, and the ratepayer or their estate would not receive any money

from selling the house.4

2.34

Conversely, high increases in property values can partially offset the cumulative

effect of postponed rates and interest. In that situation, not only would the

council be able to recover the full value of postponed rates on sale of a property,

but there would also be a substantial portion of the sale proceeds left for the

ratepayer or their estate.

Figure 1

Effect of rates postponement on equity in example property A

Figure 2

Effect of rates postponement on equity in example property B

1: 1 Section 59 of the Local Government (Rating) Act 2002.

2: The rates rebate scheme was established in 1973 to provide a subsidy to low-income homeowners on the cost of their rates. The rates rebate thresholds were changed with eff ect from 1 July 2006. The maximum rebate has increased from $200 to $500, and the income threshold has increased from $7,400 to $20,000.

3: The interest rates used represent assumptions about the councils’ rate of borrowing, which will be passed on to the ratepayer as the interest rate charged on postponed rates. The consortium’s current fees have been taken into account in calculating the results shown in Figures 1 and 2.

4: The rates postponement consortium charges a levy on postponed rates that is intended to cover the council’s loss if this situation occurs.

page top